By Lukman Otunuga Research Analyst, ForexTime

Nobody likes getting up on the wrong side of the bed.

Yet this has been the Dollar’s reality over the past few days as investors attacked the currency at any given opportunity.

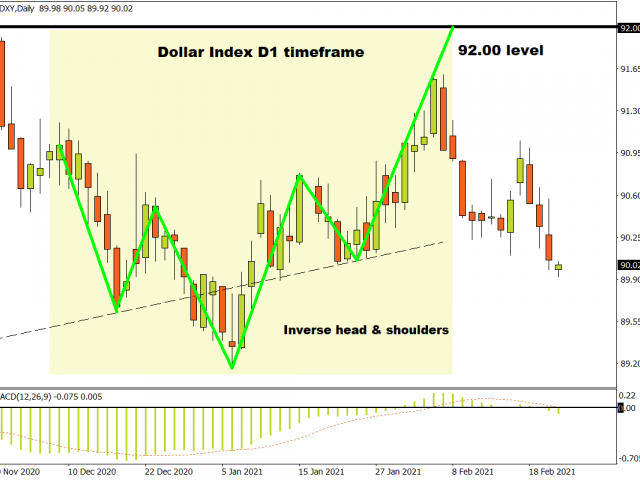

The inverse head and shoulder pattern back in January initially boosted hopes of the dollar rebounding back to glory. However, the great “reflation trade” and Fed’s ultra-accommodative monetary policy simply threw a proverbial wrench in the works for bulls.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

As the string of good news on the vaccine front elevates global sentiment and reinvigorates risk appetite, this could be bad news for the safe-haven dollar. Also, hopes around Joe Biden’s $1.9 trillion stimulus package boosting the US economy and leading to inflationary pressures are likely to weigh heavily on the already tired dollar.

Before we dig into the technicals, let us not overlook Fed Chair Jerome Powell’s testimony and US consumer confidence report later in the day. Markets are expecting Powell to reiterate the ultra-accommodative stance of the Federal Reserve and the need for more fiscal stimulus to support growth. These dovish comments may enforce additional pressure on the Dollar. In regards to the US consumer confidence, it is expected to rise slightly to 90 in February from 89.3.

Dollar knocks on 90’s door…

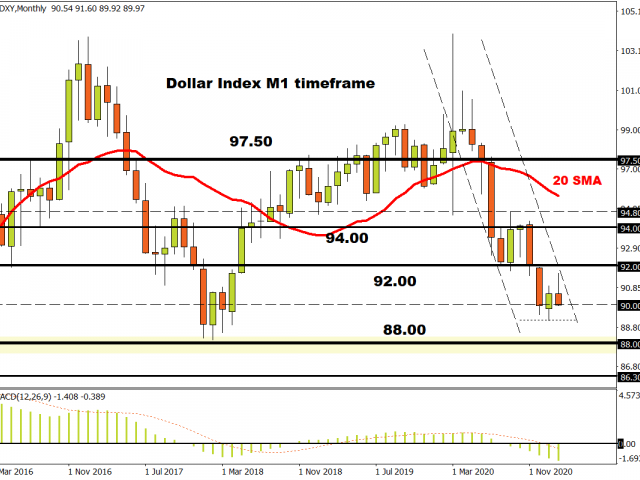

It is safe to say that the Dollar Index (DXY) remains heavily bearish on the monthly timeframe. There have been consistently lower lows and lower highs while the MACD trades to the downside.

A strong monthly close below 90.00 could seal the deal for bears with the next key levels of interest around 89.20, 88.00, and 86.30.

The weekly timeframe illustrates a similar picture. Prices are respecting a weekly bearish trend while the candlesticks are trading below the 50 & 20 Simple moving averages. Bears clearly remain in a position of power below the 91.50 higher low. Sustained weakness under this level may open a path towards the 89.00 support level. If prices end up cutting through this checkpoint, the monthly targets of 88.00 and 86.30 will be on the table.

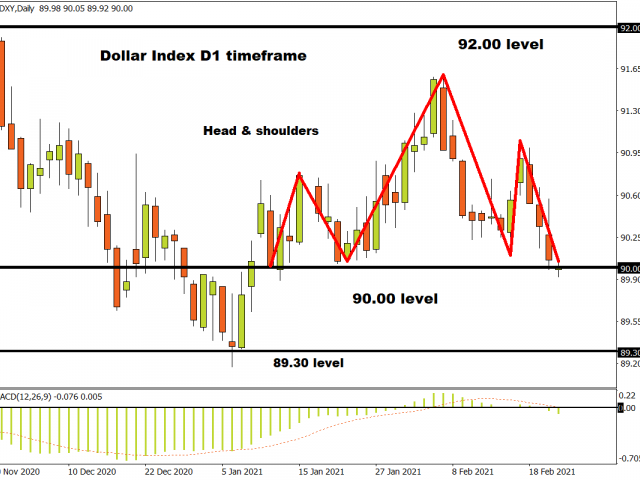

D1: Head and shoulders?

Well, what do you know? A head and shoulders pattern has formed on the daily timeframe with 90.00 acting as key support. A strong daily close under this level should instill DXY bears with enough inspiration to drag prices lower in the week ahead.

Commodity spotlight – Gold

After hitting an eight-month low last Friday, Gold has entered the week in better shape thanks to caution ahead of key speeches and economic data.

The precious metal remains supported by a weakening Dollar and reflation trade. Although the daily trend is starting to point south amid the consistent lower highs and lower lows, bulls still have a shot at the throne. If risk aversion makes an unwelcome return or the Dollar extends losses, Gold has the potential to push back above $1820.

Looking at the technical picture, a solid daily close above $1820 could spark an incline towards $1850 – a level below the 50,100 and 200 Simple Moving Average.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024