By Han Tan Market Analyst, ForexTime

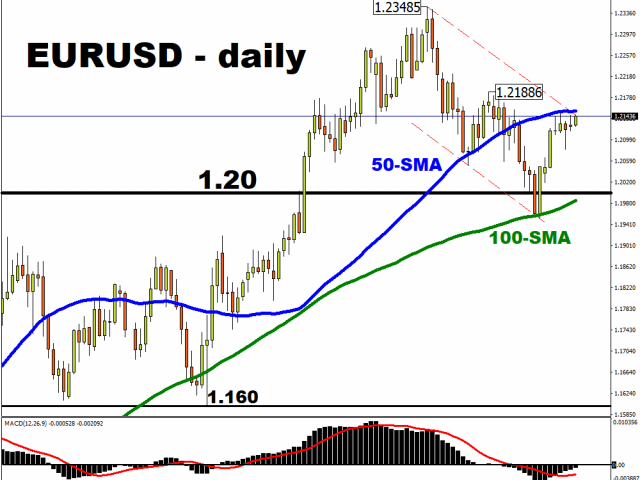

EURUSD has been testing its 50-day simple moving average (SMA) as a key resistance level of late. Although the currency pair’s uptrend since late May remains intact, with its 100-day SMA serving as a trusty support level on a couple of occasions since November, the shared currency has weakened by about 0.7 percent against the US dollar so far in 2021. The euro has also declined against most G10 and Asian currencies on a year-to-date basis.

After bouncing off its 100-SMA as a support level earlier this month, the euro still has to break above the 1.21886 mark against the greenback in order to send a more convincing signal to the markets that it can overcome the year-to-date downtrend.

Such a mark could be attained, if the momentum indicator (MACD) can cross over and stay in positive territory.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Fundamental traders will have plenty of economic data and events to digest this week in ascertaining where the euro could be headed over the immediate term:

- Tuesday, 16 February: Euro-area Q4 GDP; German ZEW survey expectations (February)

- Thursday, 18 February: ECB January meeting minutes

- Friday, 19 February: Markit PMIs for Euro-area (February)

Note that this mix features some backward-looking data (GDP) and some forward-looking indicators (ZEW survey, PMI).

Euro bulls have to overcome double-dip fears

Yesterday’s (Monday, 15 Feb) release of the euro-area industrial production has illustrated once more the damaging economic effects from virus-curbing measures. For December, industrial output came in lower than expected, registering a 1.6 percent decline compared to the month prior, while the year-on-year contraction was at 0.8 percent.

Such weaker economic data sets up the euro-area for another contraction in this current quarter.

Even though the Covid-19 vaccine is being rolled out across the continent, the pace of the dissemination has been slower-than-expected. Until the vaccine can reach a sizeable enough portion of the EU population, economic conditions are set to remain constrained.

Still, given the forward-looking nature of the markets, euro bulls will be pinning their hopes that the euro-area can begin in earnest its vaccine-fueled recovery in Q2.

Such optimism, should it go unchallenged, could offer some tailwinds to the euro and push it closer to its year-to-date high of 1.23485.

Dollar to have major say on EURUSD performance

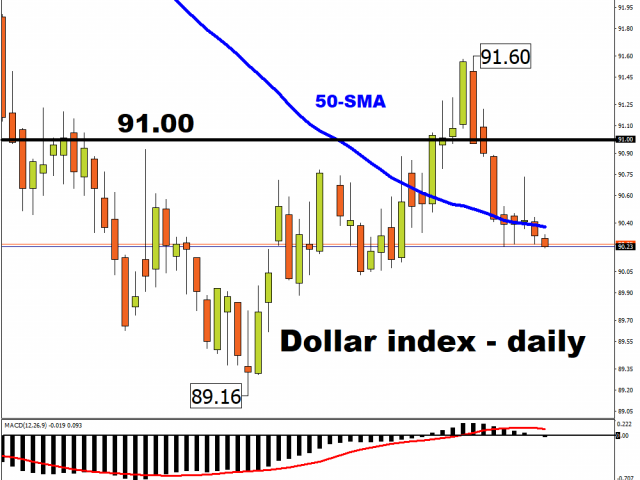

Despite the euro’s heft on the dollar index (DXY), with the former accounting for 57.6 percent of the latter, the DXY is more likely to react to the US reflation trade rather than Europe’s economic performance. The DXY has returned to trade below its 50-day SMA at the time of writing, with the greenback posting a month-to-date decline against most of its G10 peers as well as versus most Asian currencies.

It remains a dollar story at the moment, and much is dependent on the US inflation outlook. With US breakeven rates rising higher, it shows that markets are anticipating US inflationary pressures to come through. This being fueled by hopes of more incoming US fiscal stimulus, and the vaccine’s continued distribution across the US population.

This narrative is eroding demand for the dollar.

The incoming US fiscal stimulus, coupled with the vaccine, should help form the base for the recovery in the world’s largest economy. That should prompt market participants to shed safe haven assets, as evidenced by the rising Treasury yields, and pour into riskier assets.

Such market dynamics should lend more downward pressure on the greenback, while offering more support for the likes of the euro.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024