By Lukman Otunuga, Research Analyst, ForexTime

The past few weeks have certainly not been kind to the Dollar.

It has been bashed, smashed, thrashed and steamrolled by G10 currencies throughout the final quarter of 2020.

The string of good news on the vaccine front has boosted global sentiment and stimulated investor risk appetite while hopes around a U.S. fiscal stimulus package continues to weigh heavily on the Greenback. Given how a bipartisan group of US senators are set to present a new fiscal stimulus compromise worth $748 billion, markets remain hopeful over a possible breakthrough on the horizon.

Before we dig into the technicals, let us not overlook the Federal Reserve meeting on Wednesday which could impact the Dollar’s near-term outlook. The central bank is expected to leave interest rates unchanged but there could still be some fireworks. Given how this is the last meeting of 2020, the Fed is likely to adopt a cautious stance over the near-term outlook. However, there could be optimism over the longer-term outlook given how the United States approving the emergency use of the Pfizer-BioNTech coronavirus vaccine.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

The word around town is that the Fed may issue new guidance extending its emergency bond-buying programme. If the central bank sounds dovish and expresses concerns over the swelling coronavirus cases, the Dollar could be instore for further pain.

What are the technicals saying?

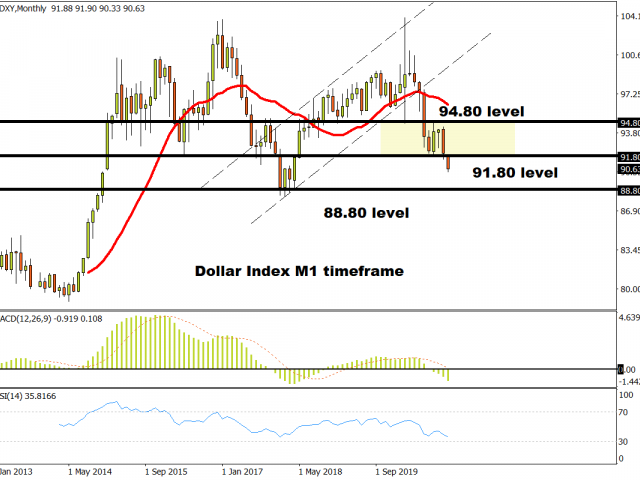

Well, the Dollar Index (DXY) is heavily bearish on the monthly timeframe. 2020 has been a terrible year for the Dollar as trades near levels not seen in two and a half years. After breaching the 92.00 support level, the DXY has cut through various levels like a hot knife through butter. Sustained weakness below 91.00 could trigger a decline towards 90.00 and 88.00, respectively.

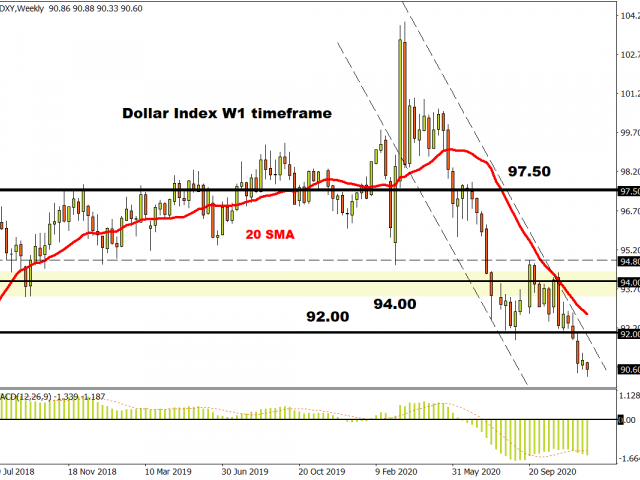

It’s the same story on the weekly charts, there have been consistently lower lows and lower highs while prices are trading below the 20 Simple Moving Average. The candlesticks are respecting the bearish channel with 90.00 acting as the next point of interest. A technical rebound towards 92.00 may be on the cards before bears attempt to drag prices lower.

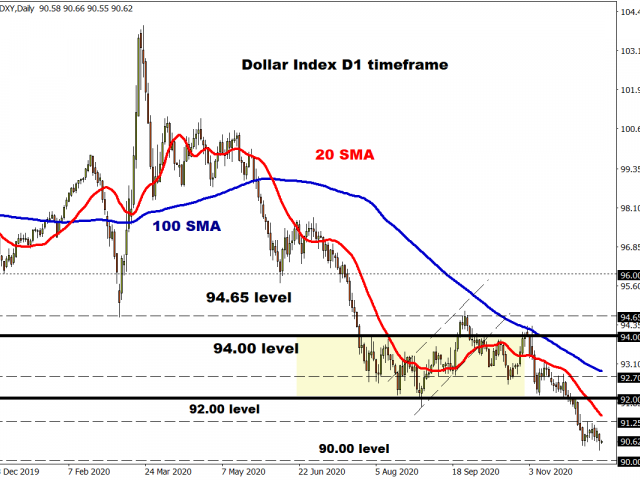

On the daily timeframe, the trend points south. Sustained weakness below the 91.25 intraday resistance could trigger a decline towards 90.00 in the near term. If prices can break above 91.25, a move towards 92.00 could be on the cards.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024