Author: Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Another negative issue for the oil appeared today, a new coronavirus strain, which was announced found by the World Health Organization in the Netherlands, Denmark, and Australia. This information elevates risks that the coronavirus pandemic might not be “beaten” soon even if the vaccination procedure starts quickly and some part of the world’s population builds up a specific immunity.

The latest data from Baker Hughes was rather bearish: over the previous week, the total number of rigs expanded by 5 units after adding 12 the week before.

At the same time, market players are positive in their response to decisions of the American regulator to stimulate and jump-start the country’s economy in order to encourage the demand for energies later.

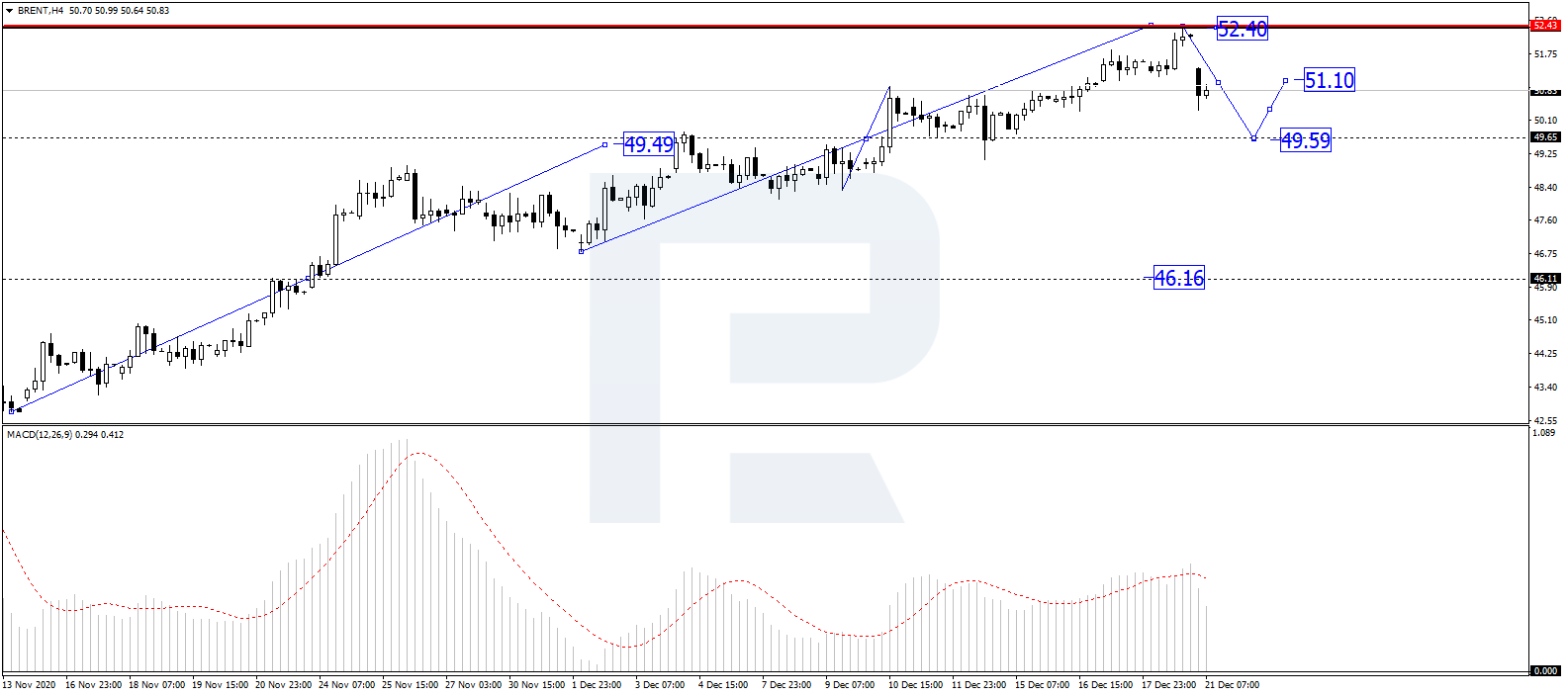

In the H4 chart, after finishing the ascending wave at 49.49 and then forming a new consolidation range around this level, Brent has broken it to the upside to reach 52.40; right now, it is falling. Possibly, the asset may return to test 49.49 from above and then form another ascending wave with the target at 51.10. From the technical point of view, this scenario is confirmed by MACD Oscillator: after leaving the histogram area, its signal line is expected to fall towards 0. If later the line breaks this level, the correctio on the price chart may continue down to 46.16.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

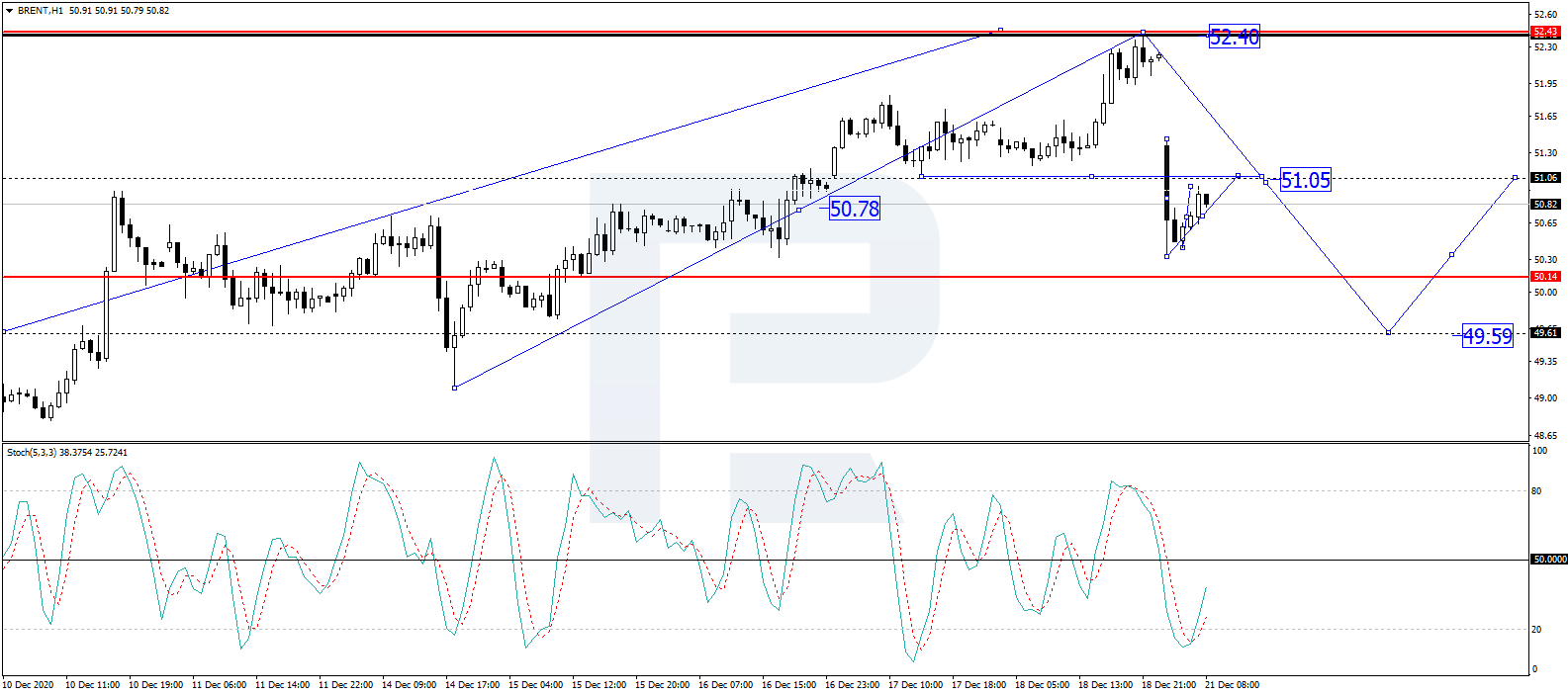

As we can see in the H1 chart, after rebounding from 49.10 and almost completing the ascending wave at 52.40, Brent is moving downwards and has already broken 51.03 to reach the short-term target at 50.33. Possibly, the asset may correct to test 51.05 from below and then start another decline towards 49.59. Later, the market may form one more ascending structure to return to 51.05. From the technical point of view, this idea is confirmed by Stochastic Oscillator: after breaking 20 to the upside, its signal line continues moving towards 50. After that, the line is expected to rebound from 50 and resume falling to return to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024