By Lukman Otunuga, Research Analyst, ForexTime

The spotlight shines on the Bank of England (BOE) this afternoon as it makes its final interest rate decision of 2020.

Markets widely expect the central bank to leave interest rates unchanged at 0.1% and its quantitative easing program at £895 billion thanks to Brexit related uncertainty and confusion over the new Christmas lockdowns. As the BOE waits to see if a possible no-deal Brexit exposes the UK economy to downside shocks, investors may peruse the MPC minutes for clues on negative interest rates.

While the central bank is set to keep its powder dry until there is clarity around Brexit, expect the BoE to act swiftly should the economic outlook deteriorate.

Another contraction around the corner?

2020 was not a kind year for the UK economy. It suffered its worst economic contraction in centuries as the coronavirus menace spread its poisonous tentacles across key sectors. Given how businesses are under the mercy of renewed lockdown restrictions, the BOE is forecasting another contraction in the final quarter of 2020. While the rollout of vaccinations is a welcome development and continues to uplift sentiment, the positive impacts may take months to be reflected in growth.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

What about Brexit and the looming deadline?

There seems to be growing optimism over an 11th hour Brexit trade deal before the transition period ends on 31st December.

Is this optimism misplaced?

The so-called level playing field and fishing rights remain major obstacles that are likely to sabotage any deal. Although there have been reports over the EU seeking compromise with the UK to maintain a level playing field, this all sounds too familiar. With just two weeks left until the transition period ends, time is dangerously running out for a deal.

Will a no-deal Brexit result in negative rates?

According to Bloomberg economics, the COVID-19 menace and Brexit may leave the UK in a vulnerable position, shaving up to 8% in long-term growth. Such an unfavourable scenario may fuel speculation around the BOE enforcing negative rates in an effort to stimulate economic growth.

Negative interest rates are an unorthodox monetary policy used by central banks to jumpstart growth by encouraging spending and essentially penalizing saving. When central banks set negative interest rates, commercial banks must pay the central banks interest to park their money with them! Such a move prompts depositors to invest rather than save – and this supports economic growth.

While such a last-ditch monetary policy tool could be effective in reviving growth, there are concerns over the sustainability of this tool in the long term. This is a discussion for another time…

What does this mean for the Pound?

The Pound has appreciated against every single G10 currency this week, gaining over 2.5% versus the Dollar. While Dollar weakness has played a role in the GBPUSD’s impressive decline, much of the upside is based around hopes of a Brexit trade deal.

Although the Pound remains heavily influenced by Brexit developments, any whiff of negative interest rates from the Bank of England could limit the Pound’s appreciation. The idea of the BOE enforcing negative rates may fuel expectations of narrowing interest rate differentials between the Pound and other currencies.

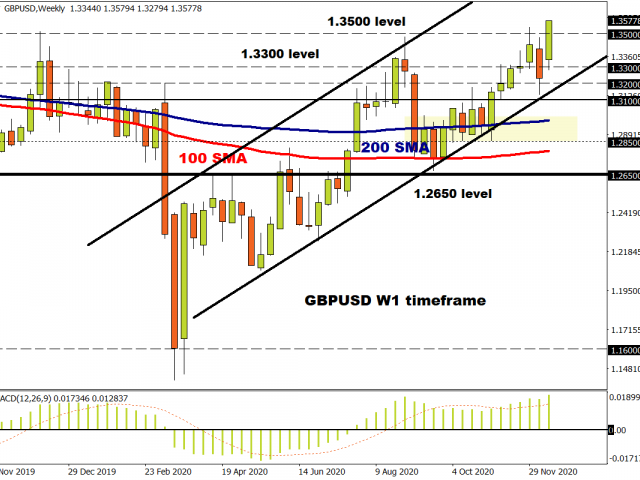

Looking at the technical picture, the GBPUSD is bullish on the weekly timeframe as there have been consistently higher highs and higher lows. Prices have blasted through the 1.3500 level this week and may push higher on Dollar weakness and Brexit related optimism. Key levels of interest to watch for will be around 1.3500, 1.3600, and 1.3680.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024