By Han Tan, Market Analyst, ForexTime

So much for Friday the 13th being unlucky.

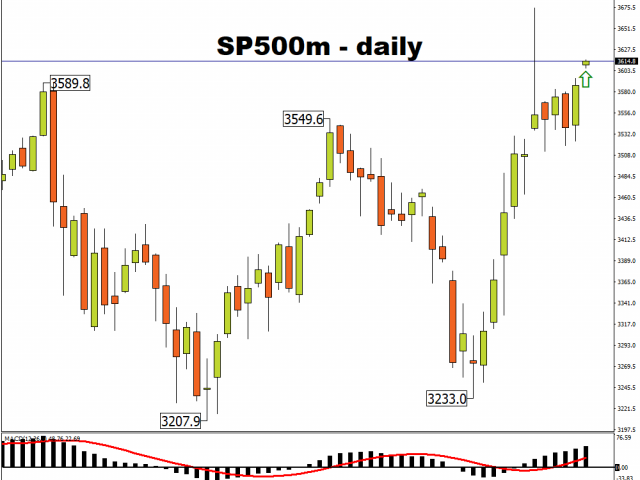

The S&P 500 posted a new record high on Friday after advancing 1.36 percent on the day, rewarding equity investors who have stuck it out amid a bumpy ride since it last posted its previous record high on September 2. Over the past two months, investors have weathered a resurgence in the global pandemic, a dip into a technical correction for the S&P 500, and also US elections risk, before being duly rewarded.

Heartened by the Friday’s historic moment, equity bulls are now sending US stock futures popping at the start of the new trading week, which suggests further gains at the US markets’ open on Monday.

In fact, both instances of Friday the 13th in 2020 have produced notable gains for this benchmark US stock index. On the only other Friday the 13th this year, which occurred back in March, the S&P 500 registered a 9.29 percent advance for the day. However, that meant little, given that global equities found themselves amid a careening market, with the S&P 500 plummeting by 34 percent between February 19th and March 23rd this year.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

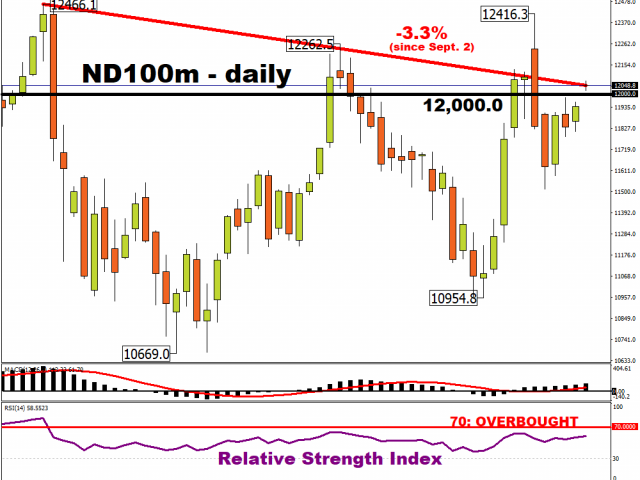

Perhaps what is slightly unusual is that the S&P 500 registered a new record high at a faster pace compared to the Nasdaq 100, considering that tech stocks have been the darling of equity markets around the world since Covid-19 gripped major economies in the first quarter of 2020.

The Nasdaq 100 Minis remain some three percent away from its highest record closing price, registered on September 2nd. Still, the index appears to be narrowing the gap, and has more room to climb before reaching overbought levels as per its 14-day relative strength index.

The discrepancy between the S&P 500 and the tech-heavy index indicates that investors are now getting more comfortable pouring money back into economic sectors that have been hit-hard by the pandemic, such as energy, financial, and industrial stocks, which are the three best-performing sectors on the S&P 500 so far this quarter.

Still, the FXTM Trader’s Sentiments remain net long on both the US Tech 100 (Mini) and the US SPX 500 (Mini).

From a fundamental perspective, global investors were given a slate of new positive headlines to cheer.

China’s on Monday reported a better-than-expected 6.9 percent advance in last month’s industrial production data, while October’s retail sales grew at a healthy 4.3 percent compared to the same month last year. Investments into properties and fixed assets also exceeded market expectations. China’s economic performance is buffering the region’s recovery prospects, while propelling the MSCI Asia Pacific index to new record highs.

Besides the abating of US election risk, pandemic advisers to US President-elect Joe Biden have publicly opposed a nationwide lockdown in the world’s largest economy. Also over the weekend, major global economies such as China, Japan, and ASEAN nations signed the world’s largest regional free-trade agreement. Such developments bode well for the global economic recovery, and in turn should feed into further gains for equities.

Still, the seasoned investor would know that not everything is plain sailing in global markets, and significant downside risks remain, with Covid-19 still demonstrating its grip on major Western economies, coupled with Brexit negotiations still rumbling along. If 2020 has taught us anything, is to guard ourselves from complacency, as risk sentiment could be derailed at any time by the unexpected.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024