By Lukman Otunuga, Research Analyst, ForexTime

The trumpets were ready, the bunting unfurled but sadly they’ve all had to be put away for the time being as the Dow failed to break 30,000 and beyond. The broader S&P500 has also struggled at the highs as the markets battle with short-term virus pain and longer-term vaccine joy.

The Dow hit the 20,000 historic milestone on 25 January 2017 after rallying some 1,700 points after President Trump’s election victory in November of the previous year. Wall Street was betting big that Trump’s plans to slash taxes, cut regulation and ramp up infrastructure spending would make the American economy great again. History is probably the best judge of that bet, with the main driver now being, in company specific terms at least, Apple.

Since hitting 29,000, the tech giant has contributed nearly 1,300 points which is more than twice that of any other Dow component. Of course, round numbers are points of interest more for the cover of Time magazine than traders and investors especially with a price-weighted index like the Dow, but we can at least add this landmark (when it happens) to the collection of tech stats which have fuelled this year’s indices performance.

Revealing S&P technical indicator

Interestingly, many observers are talking about the ‘great rotation’ out of growth and the US, and into value stocks and the rest of the world. If we switch our focus to the S&P500, we can see that the distance between the index and its 200-day Moving Average is now two standard deviations above the mean, for the first time since May 1999. This generally means there is a high chance of a major pullback as the market has discounted a lot of good news already. Time will tell as we head into a long winter and with prices nestling on previous cycle highs from September and October.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

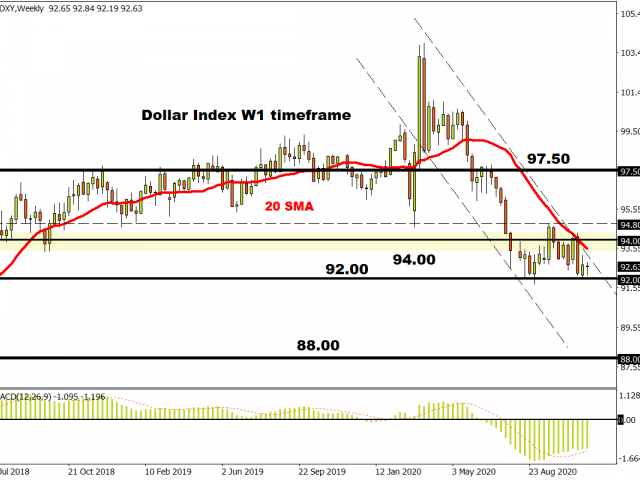

DXY holding key level

The Dollar is widely expected to struggle next year as low yields, relatively slow growth expectations and reduced trade tensions all deliver a sucker punch to the greenback. The market is already short King Dollar but for the time being seems reluctant to add to these positions. The surge in infection rates is holding up the world’s reserve currency as it bangs on the exit door to levels not seen since April 2018. In fact, the lack of support below the 92 zone is striking with bears eyeing up the 2018 lows just above 88.

With EU leaders struggling today to get agreement on the pandemic relief package, risk assets may be kept in check into the weekend and put a floor below USD for now.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024