By Lukman Otunuga, Research Analyst, ForexTime

Hopes for a successful post-Brexit trade deal has boosted the British Pound against the Dollar and most G10 currencies this week.

Buying sentiment towards Sterling received a solid boost on Tuesday following reports that the U.K and European Union could find a middle ground on future trading and security relationship as early as next week. Earlier today we covered the fundamentals behind such a key development, now our focus turns to the technicals and potential trading setups on the GBPUSD and other Pound crosses.

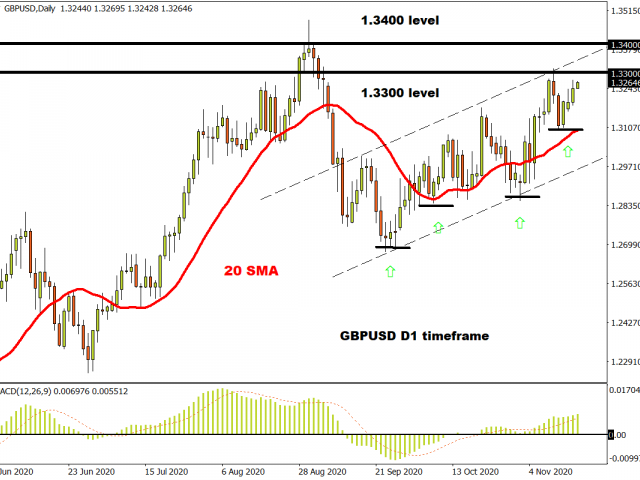

GBPUSD eyes 1.3300

The GBPUSD is bullish on the daily timeframe. There have been consistently higher highs and higher lows while the MACD trades to the upside. Pound bulls are eyeing the 1.3300 resistance level. A breakout above this point could open the path towards 1.3400.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

On the weekly charts, bulls remain in control above the 1.3100 higher low. A solid weekly close above 1.3300 may trigger a move towards 1.3482.

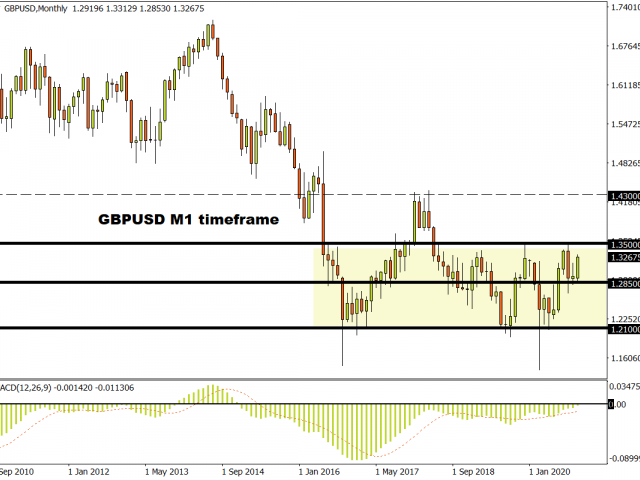

It has been more than two years since the GBPUSD traded above the 1.3500 level. The upside momentum may notch up a gear if 1.3500 is conquered on the monthly timeframe. A solid close above this point may trigger a move towards levels not seen since April 2018 above 1.4300.

EURGBP pressured below 0.9000

An appreciating Pound is likely to keep the EURGBP below the 0.9000 resistance level. An intraday breakdown below 0.8950 could signal a decline towards 0.8900 and 0.8870. This bearish setup becomes invalidated if prices rebound above the 0.9000 lower high.

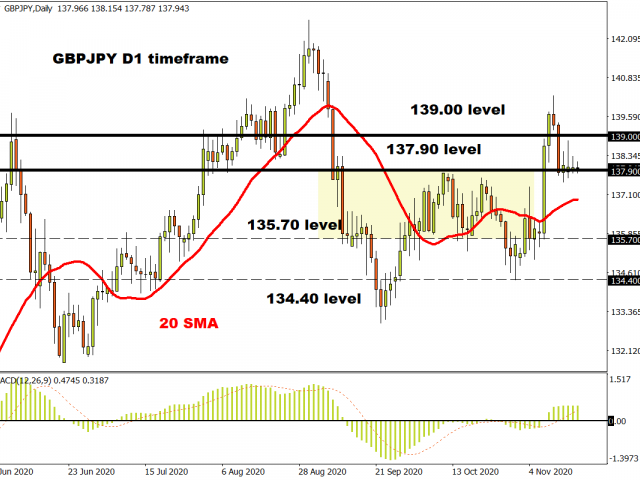

GBPJPY balances above 137.90

The title says it all. Prices remain trapped around the 137.90 regions. However, lagging indicators such as the MACD and 20 simple moving average pointing to further upside. Should 137.90 become the new higher low, the GBPJPY could rebound towards 139.00 and beyond. Alternatively, weakness under 137.90 is likely to trigger a selloff towards 136.50.

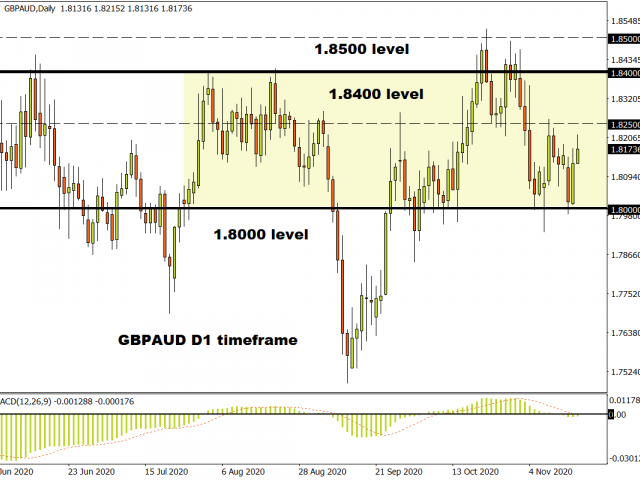

GBPAUD playing the range

The pound remains in a wide range against the Australian Dollar with support at 1.8000 and resistance at 1.8400. An intraday breakout above 1.8250 could trigger an incline towards 1.8400. If 1.8250 proves to be reliable resistance, prices have scope to decline back towards 1.8000.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024