By Lukman Otunuga, Research Analyst, ForexTime

The past few days have been tense and eventful for financial market as investors grappled with the US election cliff-hanger and surging coronavirus cases in the parts of Europe, North Africa and the United States.

As this exhausting and emotionally draining week slowly comes to an end, there still remains a strong sense of anticipation as market players await final results of the tightly contested presidential race. Exit polls are indicating a win for Democrat challenger Joe Biden with a divided Congress. While this is not the ‘blue wave’ outcome initially expected, it may open doors to a smaller stimulus package – something that continues to weaken the Dollar.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

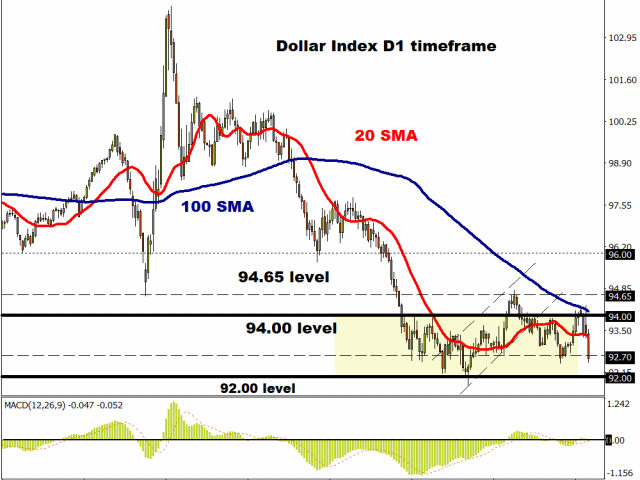

For my technical traders, the Dollar Index is under increasing pressure on the daily charts. Prices are trading below the 20 and 100 Simple Moving Average while the MACD trades to the downside. The breakdown below 92.70 could open the doors towards 92.00 in the near term. The Index may be dragged lower this evening if the Federal Reserve adopts a dovish tone and expresses concerns over COVID-19 and US economy.

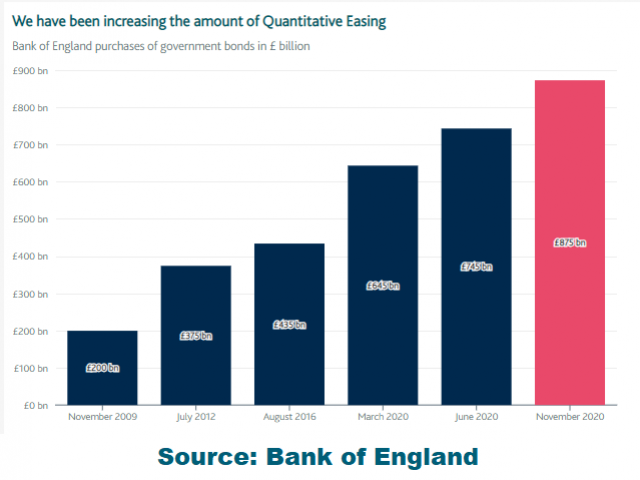

Away from US politics, the British Pound received a solid boost this morning after the Bank of England expanded the Quantitative Easing (QE) program by £150 billion to £895 billion.

Why it matters?

Quantitative easing is a monetary policy tool that central banks use to inject money directly into the economy.

It involves large-scale purchases of government debt in the form of bonds which essentially pushes down the interest rates offered on loans. Lower interest rates make it cheaper for households and businesses to borrow which could stimulate consumption.

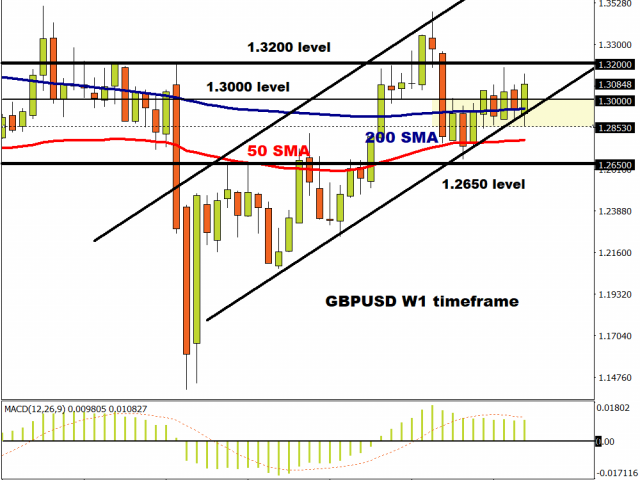

With new lockdown rules being imposed across England today, fears remain elevated over a double-dip recession. On top of all of this, Brexit uncertainty still remains a certainty!

Despite the gloom and doom, the GBPUSD remains bullish on the weekly charts. Could bulls be third time lucky by securing a solid weekly close above 1.3100? Such a scenario may re-open doors back towards 1.3200.

A wild week for the EURUSD

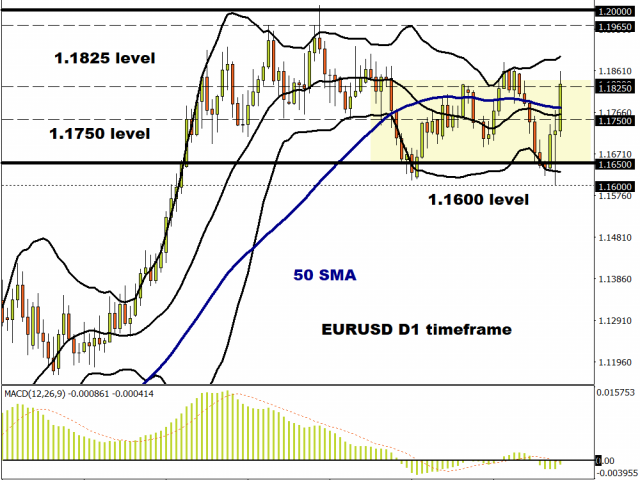

The EURUSD has staged a solid rebound from the 1.1600 support level this week thanks to a weaker US Dollar.

Looking at things from a purely technical perspective, bulls could be back in town if a daily close above 1.1860 is achieved. Such a move could swing open the doors to the next key resistance level at 1.1965 and 1.2000. Should prices remain trapped below 1.1825, the currency could decline back towards 1.1750.

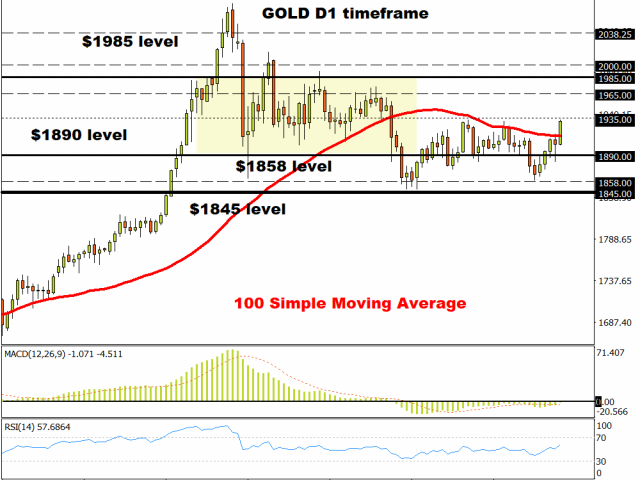

Commodity spotlight – Gold

Gold’s bullish price action highlights how markets are pricing in a Biden victory.

However, things could turn volatile for the precious metal if Trump contests the election results and seeks the Supreme Court’s intervention. Despite the rally in equity markets, investors remain somewhat jittery and this could fuel appetite for safe-haven Gold.

Looking at the technical picture, the precious metal is turning bullish on the daily charts. A solid breakout above $1935 may trigger an incline towards $1965.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024