By Lukman Otunuga, Research Analyst, ForexTime

It’s been a long campaign, an even longer year it feels and yet with any luck, we will get to find out the next occupier of the Oval Office over the next few hours. Much has been said and written already, but it’s undeniable that this is an historic election like no other US presidential one, with a unique sitting commander-in-chief who has been rallying hard in the last few days.

Markets, rather curiously, are also rallying and in upbeat mood this afternoon, despite the pessimistic headlines around the global pandemic situation. This is remarkable in one sense when one thinks that most observers believed risk would be taken off, if anything, ahead of a still uncertain election result. More so too when the recent narrative has been that no clear winner will emerge before tomorrow or even later in the week.

Popcorn viewing, but watch for the ‘Blue Mirage’

For those readying themselves for a night of tension, razzmatazz and history, key states to watch out for initially include North Carolina and Florida. These two states, and the latter especially should be viewed as a lead indicator for a potential outright winner as more than 56% and 65% mail in ballots have been returned. These votes can be counted already so if Joe Biden secures one of these or even both, then the chances for Donald Trump fall dramatically. One of the first polls will come from Ohio at around 1am UK time. This state has been a presidential fortune-teller in the past as it has backed the winner at every contest bar one since World War Two. But if it’s close in Ohio, don’t expect a projected winner on the night. It is also important to note that early voting in certain states is due to tip initial results towards the Democrats, before in-person voting balances out Republican support.

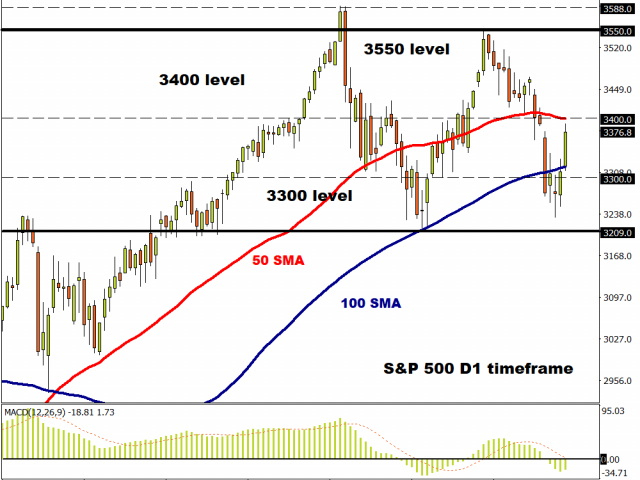

Markets are not looking back currently, with global stocks roaring higher as if not a care in the world! The S&P 500 has scythed through the 100-day Moving Average which looks to have again acted as strong support. The 50-day MA is now above around 3,400. The spectre of a US government spending splurge has also put pressure on US government bonds, with the 10-year yield touching highs not seen since June near to 0.90%.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

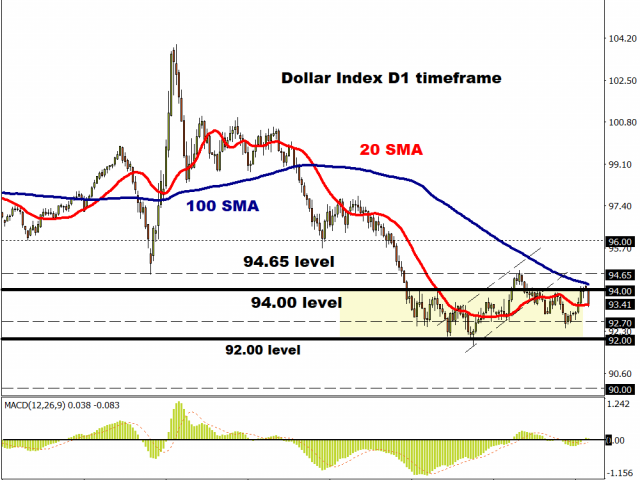

King Dollar suffering

The Dollar has slipped quite sharply in light volumes with other safe havens like the JPY underperforming too, as markets shun safety. There still appears to be some nervousness in certain pockets with the VIX for example, trading above 34 so still somewhat above its long-term average around 20. Markets will react to headlines now and adjust to the evolving political outlook in the race for both the White House and Senate.

The 100-day Moving Average looks to have acted as decent resistance for the greenback with prices falling back below 94.00. With markets seemingly positioning themselves for a Biden win, are we getting ourselves into a ‘buy the rumour, sell the fact’ type scenario? Whatever happens, strap yourselves in for some history-making…!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Lean Hogs Apr 20, 2024

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024