By Orbex

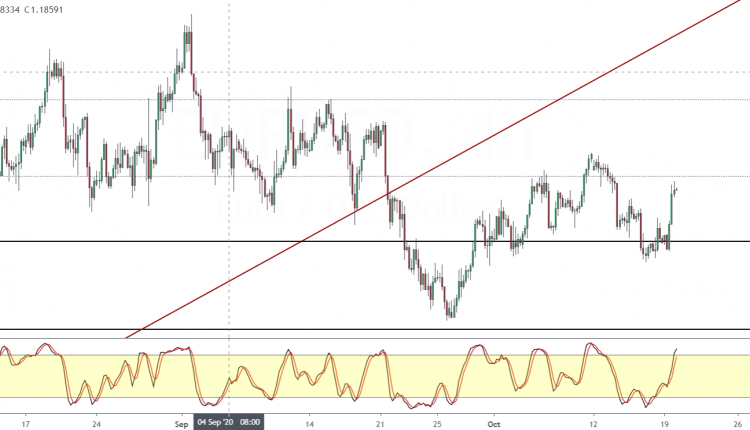

EURUSD Rises On A Weaker Greenback

The euro is trading higher on Monday, largely thanks to the weaker US dollar.

The EURUSD is reversing losses after touching the 1.1700 support area.

The current pace of gains will see the common currency re-testing the 1.1800 level again.

Depending on whether this price area will act as resistance, price action could push even higher.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

For the moment, the EURUSD remains consolidated within the 1.1800 and 1.1700 levels.

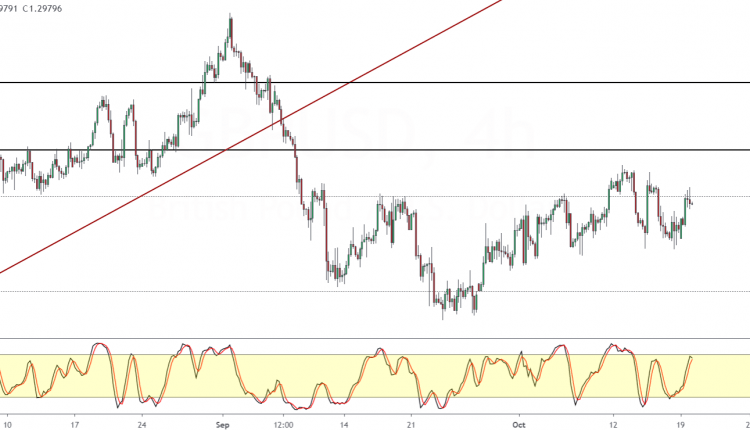

GBPUSD Rises To 1.3000

The British pound sterling is once again attempting to breakout past the 1.3000 level of resistance.

However, prices are still being rejected above this level, as 1.3000 is proving a strong resistance level to break. This will most likely keep GBPUSD confined below this level for the moment.

The Stochastics oscillator is also a bit overstretched, which could signal a pullback in price action.

The minor support near 1.2850 remains the downside line in the sand for the cable.

A close below this level will open the way for GBPUSD to test the 1.2750 level of support next.

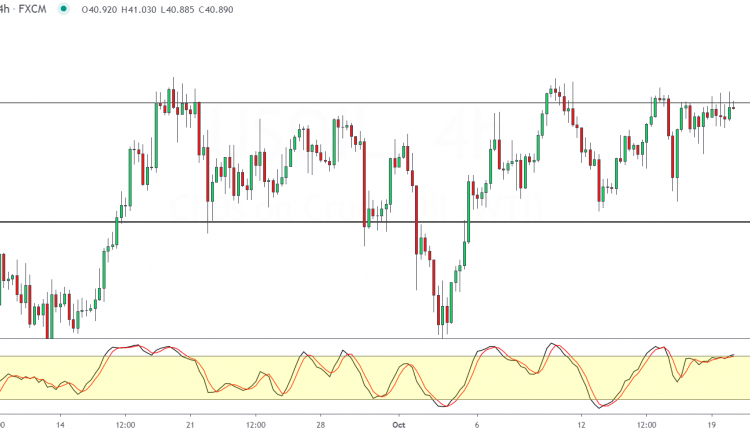

Oil Rises On OPEC+ Comments

Oil prices were trading bullish on Monday.

The gains come after OPEC+ chief reiterated that OPEC+ would not let oil prices to fall again.

Elsewhere, Russia is attempting to engage Saudi Arabia in fresh talks amid the current oil market slump.

Price action is building upon the upside momentum as oil prices briefly test the 41.00 level.

With the price action largely dependent on the fundamentals, positive news from Russia and Saudi talks could see oil possibly breaking above the 41.00 level.

For the moment though, the ranging price action is still not out of the woods.

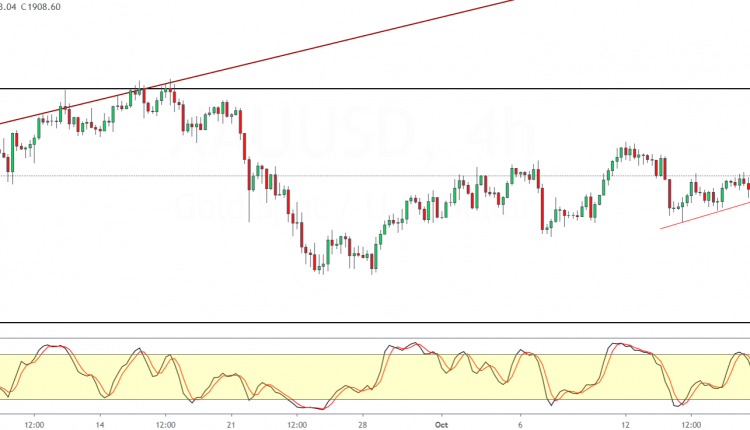

Gold Catches A Bid On Stimulus Talks

The precious metal is attempting to pare losses as the US Congress is set to debate on the stimulus bill.

This has weakened the US dollar and the talks of fresh stimulus are pushing gold a bit higher. But gold is struggling near the 1911.50 level.

After an intraday spike above this level, gold reversed gains.

For the moment, the ascending triangle pattern continues to remain in play.

Watch for a successful breakout above this level which could see further gains in gold. Alternatively, if gold loses support from the rising trend line, we could see the downside risks emerge.

By Orbex

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024