By Lukman Otunuga, Research Analyst. ForexTime

Our commodity spotlight this week shines on Gold which seems to be waiting for a fresh directional catalyst.

Since mid-August, it has felt like the same old story for the precious metal as conflicting themes left prices choppy and confined within a wide range. It is safe to say that prices are likely remain rangebound until there is a decisive breakout above the $1985 resistance or crucial $1845 support level.

Talking fundamentals, Gold initially derived strength from low-to-negative bond yields and mounting concerns over slowing global growth. After hitting an all-time high above $2070 back in August, it was downhill from there thanks to optimism over a coronavirus vaccine. Fast forward today, the key themes influencing Gold’s outlook revolves around the US presidential elections and rising coronavirus cases across the globe and the Dollar.

Let’s be honest, uncertainty remains the name of the game as the presidential elections approach a deafening crescendo while the stimulus saga in Washington has placed most on an emotional rollercoaster ride! In the latest twist and turns to this overextended series, Nancy Pelosi has set an end-Tuesday deadline to reach an agreement on the US coronavirus stimulus plan.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Why has Gold struggled to shine despite the bouts of “risk-off” and caution? Well, the primary culprit is King Dollar. Over the past few weeks, it has felt like everyone wants a juicy piece of the world’s most liquid currency in times of uncertainty. Since international gold is dollar-denominated, any strength in the Dollar weakens Gold prices and vice versa. For those who are wondering what can push Gold prices up fundamentally, the answer lies in US inflation expectations. Given how Gold is seen as a hedge against inflation, a major shift in these expectations could inject Gold bulls with a fresh dosage of inspiration.

Focusing on this week, the major risk event and potential market shaker will be the final presidential debate on Thursday 22 October. Who knows what to expect from the Trump and Biden faceoff especially after the surreal shouting match seen in round one and competing town hall events that replaced round two? If round three is anything like the first round, a wave of risk aversion may engulf financial markets. It will be interesting to see whether such an outcome supports or weakens Gold.

Back to the technicals…

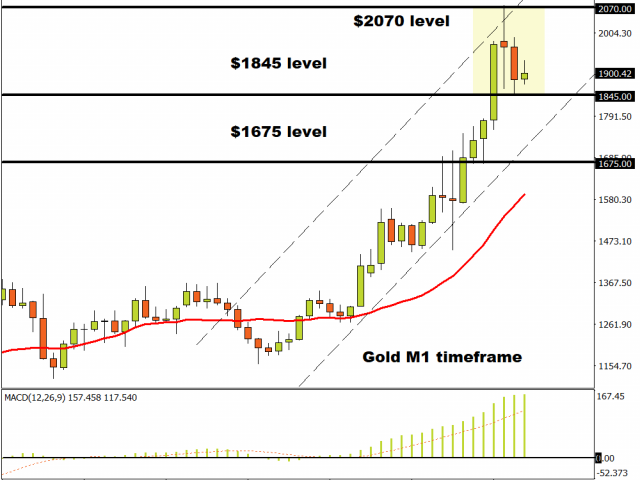

On the monthly charts, Gold remains bullish as there have been consistently higher highs and higher lows. Prices are trading proudly above the 20 Simple Moving Average while the MACD trades to the upside. If $1845 proves to be reliable support, this could end up being the new higher low that elevates Gold back towards the $1985 resistance and beyond $2000. A breakdown below $1845 could threaten the current uptrend with the next key point of interest around $1675.

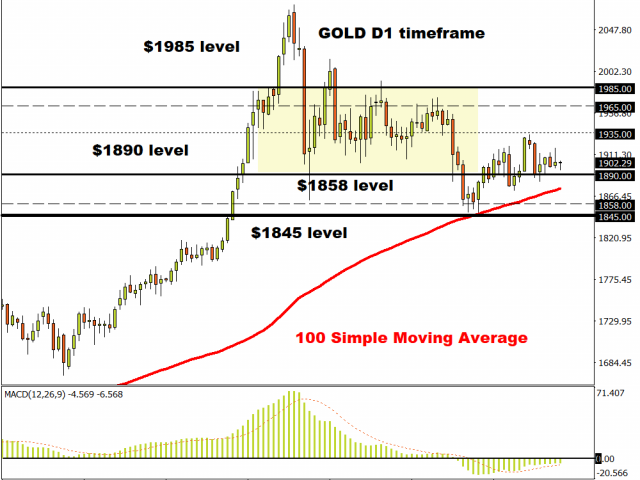

Zooming into the daily, we are presented with choppy candles and multiple ranges. Major support can be found at $1845 and major resistance can be found around $1985. There is minor support around $1890 and minor resistance at $1935 and $1965. The price action displayed on the daily suggests that Gold is waiting for a fresh directional catalyst to break out or down. Until then, the precious metal is likely to find comfort within the current $140 range!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024