By Lukman Otunuga, Research Analyst, ForexTime

A wave of optimism swept through equity markets on Monday following reports that US President Donald Trump’s health was improving after testing positive for COVID-19.

Such encouraging news has injected investors with a fresh dosage of confidence, consequently renewing appetite for risk at the expense of safe-haven currencies like the Dollar and Japanese Yen.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Our currency spotlight this week will be the Greenback which was practically bullied by G10 majors last quarter.

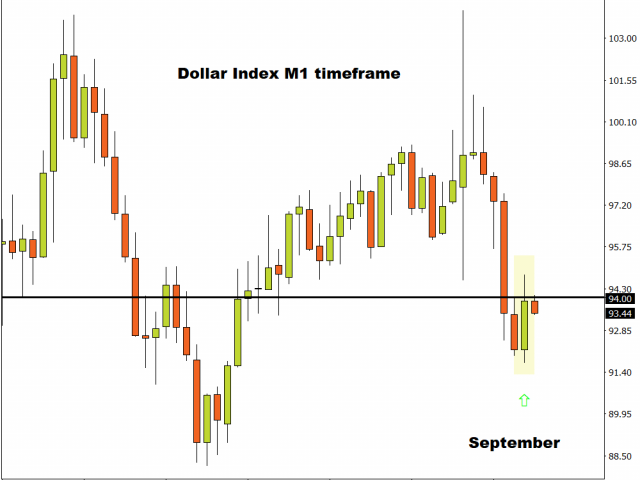

However, the Dollar’s initial performance over the past few weeks suggested that bulls were gearing for a return. Risk aversion triggered by rising coronavirus cases across the globe, political uncertainty ahead of November’s presidential elections and concerns over the global economy sent investors rushing towards the world’s most liquid currency in September.

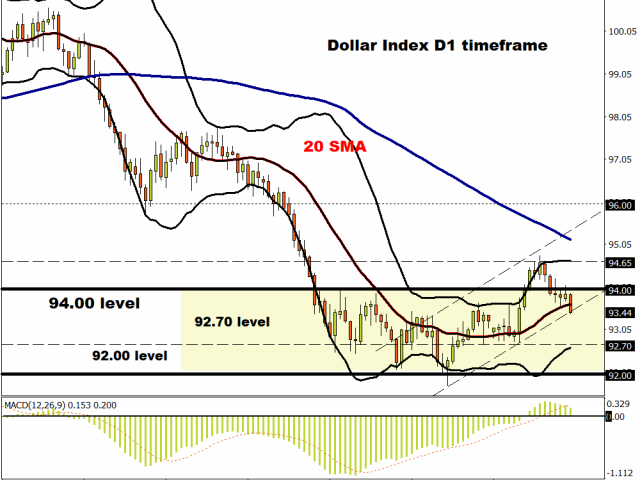

Focusing on today, Dollar bulls are nowhere to be found on the daily charts with the DXY trading around 93.50 as of speaking. There seems to be resistance around the 94.00 level while prices have cut below the 20 Simple Moving Average. Sustained weakness below 94.00 could trigger a decline towards 92.70 and 90.00, respectively.

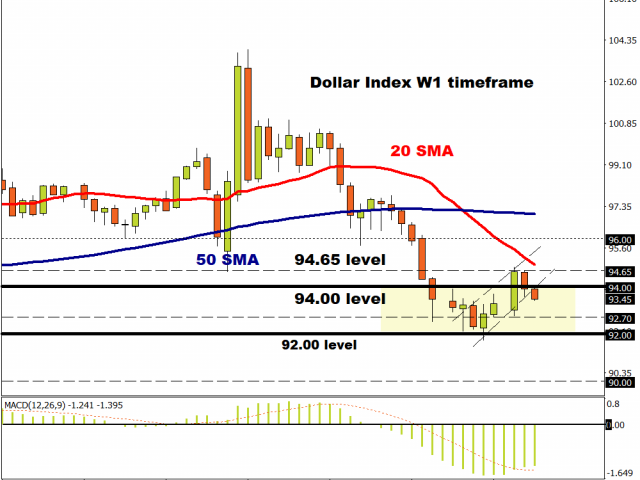

Zooming out to the weekly charts, the next key level of interest can be found around 90.00. This level could be challenged if 92.00 proves to be unreliable support. However, if prices are able to secure a weekly close above 94.00, then bulls could test 94.65 and 96.00, respectively.

All in all, where the Dollar Index concludes this week will not only be influenced by developments revolving around Trump but key economic data in the form of PMI’s, FOMC minutes, speeches from Fed officials and overall sentiment.

Although the Dollar Index is under pressure below 94.00, King Dollar could still make a return in Q4 if risk aversion remains a dominant theme across markets.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024