By Lukman Otunuga, Research Analyst, ForexTime

It’s a rather mixed market in this afternoon’s session which is perhaps to be expected ahead of the huge risk event next week across the pond. After yesterday’s deep selloff in risk assets yesterday, stocks are a touch softer today, bonds are firmer and there’s a bid for JPY, which we looked at this morning.

The Dollar is modestly weaker against its G10 peers while the ‘commodollars’ are better bid. With stimulus talks on the backburner, the incumbent is not seeing any late surge in polling support that propelled him into the Oval Office this time four years ago. A contested outcome nags at the back of many minds but Joe Biden is still out in front in both national polls and more importantly, the swing states which will determine the next commander-in-chief.

More immediately, the pandemic is occupying the market and the tough winter months ahead, especially in Europe. Volatility is creeping higher and the risk environment remains delicate, even if we know the prospects for fiscal relief are very high after the election .We’ve had mixed news on the data front to add to this uncertainty with US consumer confidence disappointing, while durable goods figures continue to show improvements in business investments with the headline figures rising for the fifth straight month.

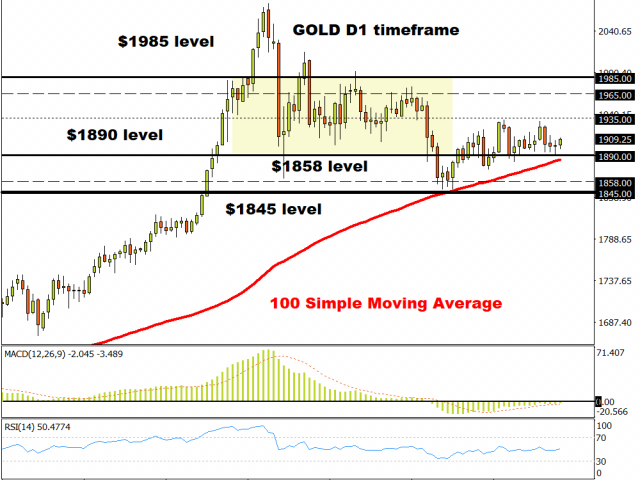

Gold coiling, waiting for catalyst

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

The yellow metal continues to struggle for direction, trading in a tight range over the past few weeks. Last weeks move higher was capped by the previous high at $1933 but prices remain well supported by the 100-day Moving Average now just below $1900 and the six-month uptrend support line.

With momentum indicators firmly in neutral mode, we await the trigger for a break. What we know for certain is that the more prices trade in a tight range and contract, the more the breakout will be expansive!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024