By Lukman Otunuga, Research Analyst, ForexTime

The sentiment pendulum swung deeper into “risk-on” territory on Tuesday morning after President Donald Trump’s departure from hospital soothed concerns about his health.

Equity bulls in Asia were instilled with a renewed sense of confidence on this news, elevating shares to levels not seen in more than two weeks. European stocks opened slightly higher with the positive mood potentially finding its way back into Wall Street this afternoon.

There seems to be a growing sense of optimism for more U.S fiscal stimulus after House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin spoke by phone for about an hour on Monday. Market sentiment could brighten if both sides reach a breakthrough on new government spending before the Presidential election less than a month away. Such an outcome may inject equity bulls with enough inspiration to retest 2020 highs. However, the road north remains filled with many obstacles in the form of rising coronavirus cases in the United States and across the globe and lingering fears around economic growth.

Dollar waits for Powell

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

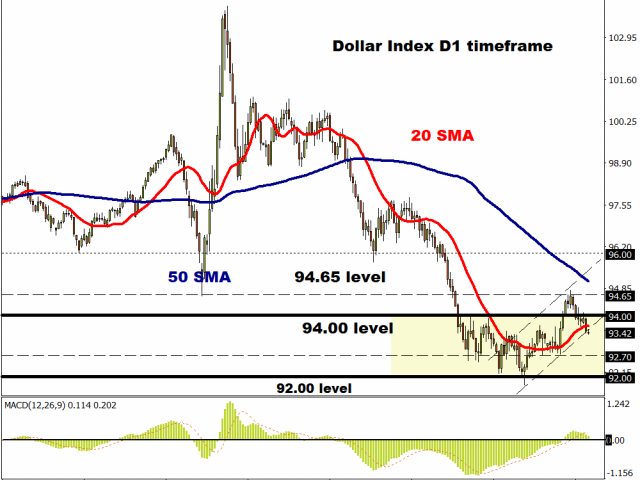

After depreciating against most G10 currencies yesterday, the Dollar has entered Tuesday’s session struggling to shake away the Monday blues. In our technical outlook, we discussed the possibility of the Dollar Index trending lower if 94.00 proves to be reliable resistance. The Dollar Index is trading around 93.48 as of writing and could slip towards 92.70 if bears can conquer the 93.30 intraday support.

Fed Chair Jerome Powell will be under the spotlight today as he delivers a keynote speech at the National Association of Business Economics (NABE) conference. Any fresh clues on monetary policy could influenced the Dollar Index (DXY) performance this week.

Currency spotlight – GBPUSD

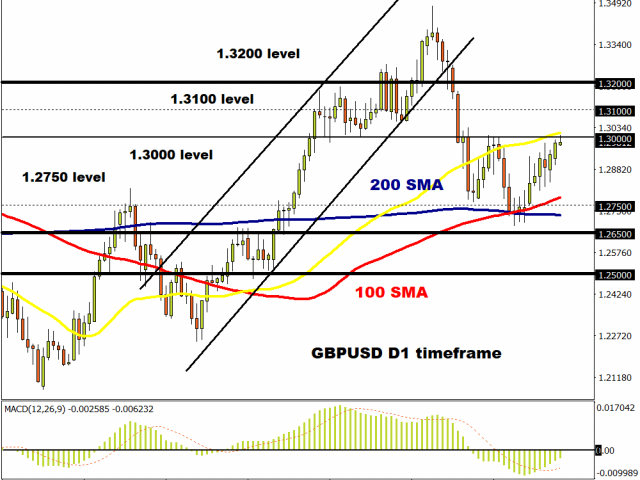

Pound bulls seem to be on a mission to conquer the 1.3000 resistance level. Looking at technicals, prices are trading above 100 & 200 Simple Moving Average while the MACD trades to the upside. A solid break above 1.3000 could open the doors towards 1.3100 and possibly higher. If 1.3000 proves to be reliable resistance, the GBPUSD may slip back towards 1.2820.

Commodity spotlight – Gold

Gold prices slightly dipped on Tuesday morning as equities roared to life following Trump’s discharge from hospital, though a softer Dollar limited the precious metal’s downside losses.

Overall, the outlook for Gold remains bright despite the risk-on mood sweeping across financial markets. Rising coronavirus cases across the world, political risk ahead of November’s US election, Brexit related uncertainty and low-to-negative US government bond yields are likely to stimulate appetite for the Gold in Q4. If the Dollar ends up weakening on rising inflationary pressure in the United States, this could prove a tailwind for Gold which is also considered an inflationary hedge.

Looking at the technical picture, the daily close above $1900 could open a path towards $1935. Should prices break back below $1900, Gold may sink towards $1865.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024