By Lukman Otunuga, Research Analyst ForexTime

It looks like everyone wants a juicy piece of the world’s most liquid currency thanks to the International Monetary Fund’s (IMF) bleak forecast and fading US stimulus hopes.

Dollar bulls were injected with a fresh dosage of inspiration yesterday after the IMF warned that COVID-19 would cause “lasting damage” to the global economy. Appetite towards the Greenback was sweetened further by dimming hopes for more fiscal stimulus before the U.S election after House Speaker Nancy Pelosi a $1.8 trillion relief proposal from the White House. With rising coronavirus cases across the globe draining investor confidence and fostering a sense of unease, king Dollar could make a return in Q4.

What are the technicals saying?

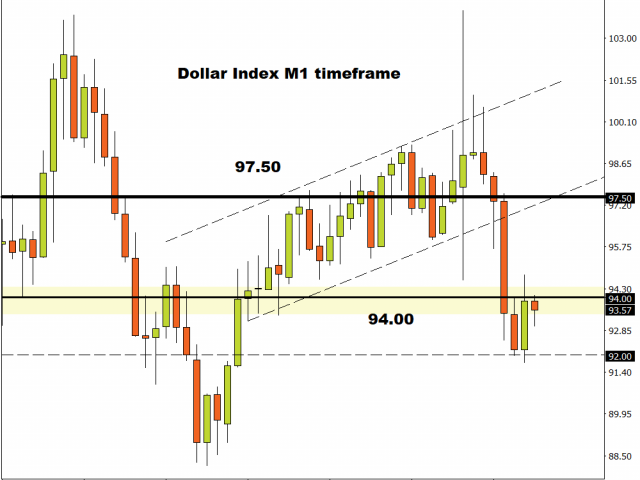

Well, the Dollar Index (DXY) is under pressure on the monthly timeframe. It is still nursing deep wounds inflicted during Q3 as vaccine optimism and stimulus hopes turbocharged risk sentiment. There is something about the 94.00 resistance which has acted a dynamic level over the past few years. A solid monthly close above this point could open a path back towards 97.50 in the medium term. Alternatively, if 94.00 proves to be reliable resistance, then prices may slip back towards 92.00.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

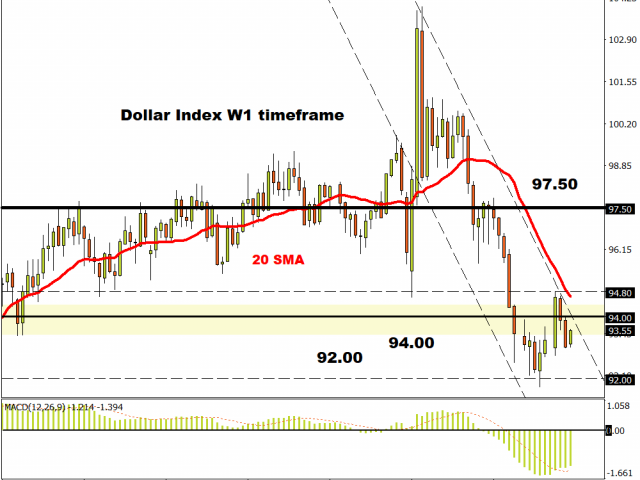

Weekly timeframe paints similar picture

Prices remain in a downtrend on the weekly charts as there have been consistently lower lows and lower highs. Prices are trading below the 20 Simple Moving Average while the MACD trades to the downside. If Dollar bulls are unable to break above the 94.80 lower high, the next key point of interest may be found around 92.00. Although technicals are in favour of bears, the fundamentals could throw the Dollar a much-needed lifeline.

A quick peek into the fundamentals

Speaking of fundamentals, US inflation rose in September at the slowest pace in four months, signalling little threat of rising inflation as the US economy heals. Consumer prices 0.2% from the prior month after 0.4% gain in August. So much for the Feds policy shift to let inflation rip higher….

Investors will direct their attention towards the latest unemployment claims data on Thursday and retail sales report on Friday. After increasing by a tepid 0.6% month-over-month in August, retail sales are forecast to rise by 0.7% in September.

Back to the technicals….

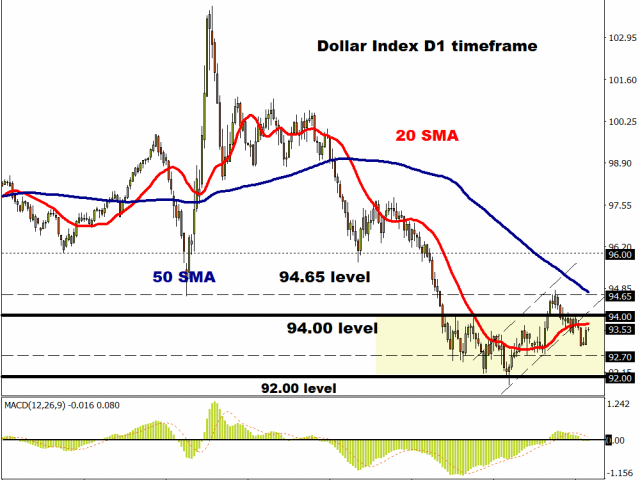

It’s all about the 94.00 resistance level on the daily charts. Bulls need to secure a solid daily close above this point to encourage a move towards 94.65 and 96.00. Prices are trading below the 20 and 50 SMA but the MACD trades to the upside. If the risk-off mood drags on amid fading stimulus hopes, election jitters and rising coronavirus cases, king Dollar may defy technicals by exploding higher.

Commodity spotlight – Gold

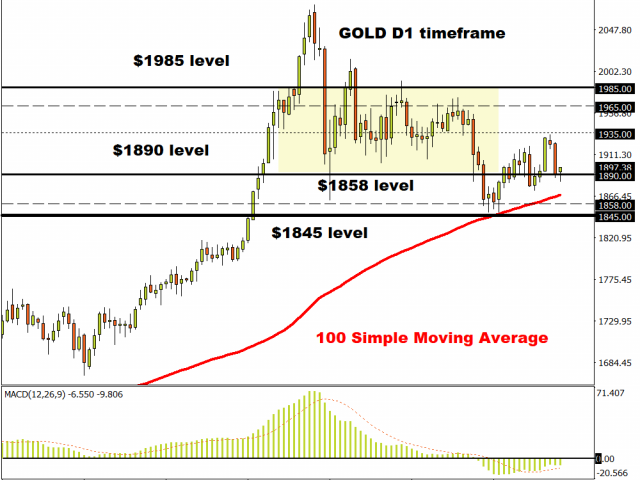

Just can’t help but feel that it has been the same old story with Gold.

Prices remain rangebound despite the stimulus developments and rising coronavirus cases across the globe. If the Dollar continues to weaken on dimming stimulus hopes, this could drag Gold prices lower despite the risk-off mood. Looking at the technical picture, the metal is down almost 2% this week with a breakout/down setup in play. If $1890 proves to be unreliable support, prices could decline back towards $1858 and $1845. Alternatively, an intraday breakout above $1935 could open the doors towards $1965.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024