By Orbex

Gold

The yellow metal has been back under pressure this week.

Following a heavy sell-off on Tuesday, from which the market has attempted to recover, gold ends the week in the red as of writing.

The rally in equities over the week has weighed on gold prices. Risk assets have been boosted by the view that further central bank easing is growing closer as concerns over the second wave of COVID continue to flourish.

Gold prices were hit earlier in the week by news that Trump has called off negotiations over a further fiscal support package. Democrats and Republicans have been trying to hammer out a new fiscal deal over recent weeks.

However, Trump announced this week that he will be postponing talks until after the elections.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Republicans had been looking for a $1.6 trillion deal while Democrats were looking for a larger $2.4 trillion package.

Trump reassured markets that he intends to pass a major new stimulus bill should he win.

Weakness in the US dollar into the back end of the week has allowed gold prices to recover somewhat.

Speaking earlier in the week, Fed Chairman Powell called on the need for further support after praising the combined efforts of the Fed and the government.

On the back of his comments, the market has increased its expectations of further central bank easing in the coming months. This should keep gold supported in the medium term.

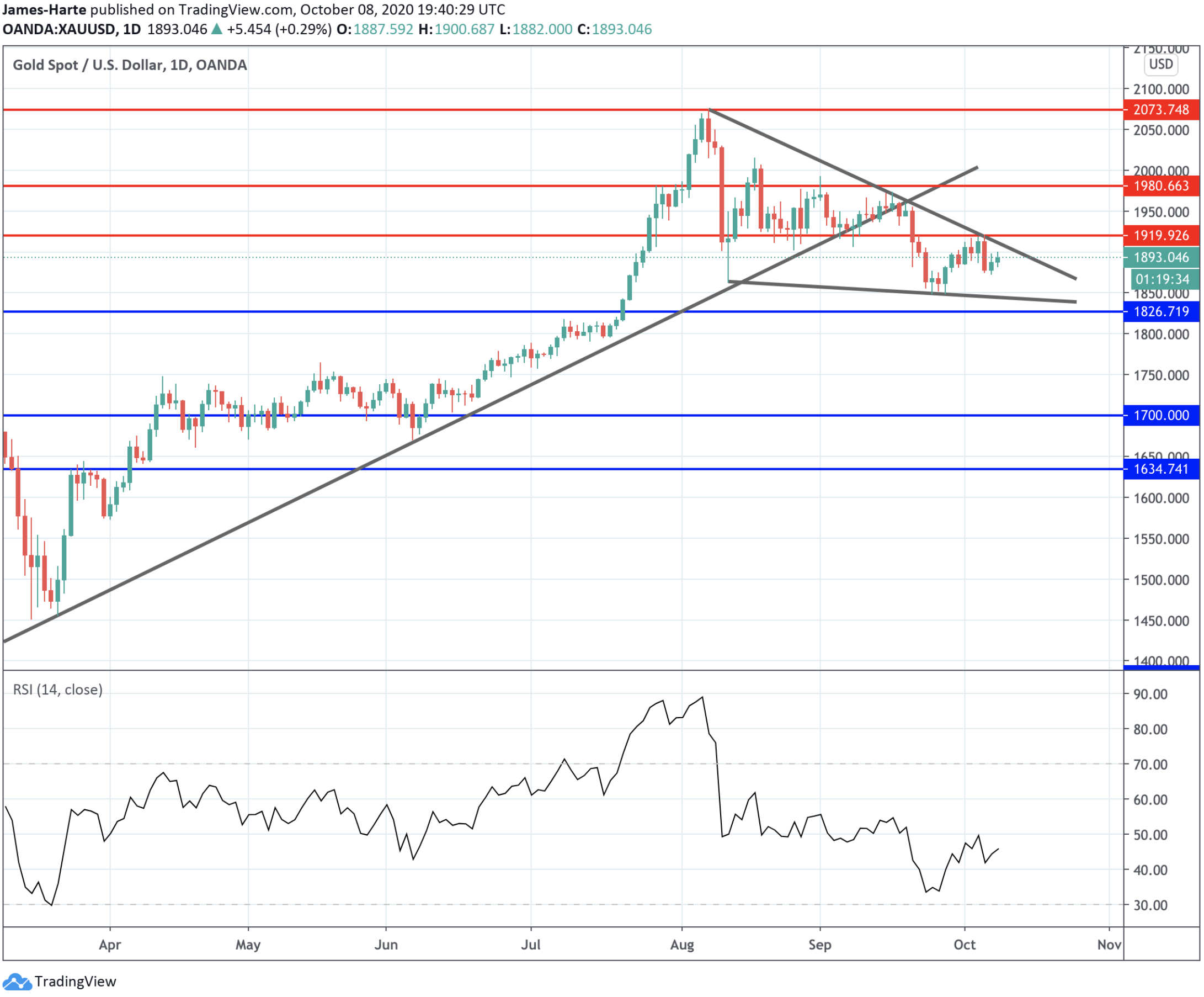

Gold Prices Trading in Falling Wedge Pattern

Having broken below the rising trend line from year to date lows, gold prices continue to trade within a falling wedge pattern which has framed the correction from all-time highs.

While still above the 1826.79 level support, focus remains on further upside.

Silver

Silver prices have traded in the same manner as gold this week with price fighting to recover from Tuesday’s sell-off.

Despite more subdued price action this week, silver prices remain underpinned by the firm rally in equities, particularly in industrial stocks.

With industrial indicators continuing to improve, the fundamental backdrop for silver remains positive.

However, fears of fresh lockdowns in the UK and Europe pose a threat to the demand outlook and traders continue to monitor the situation carefully.

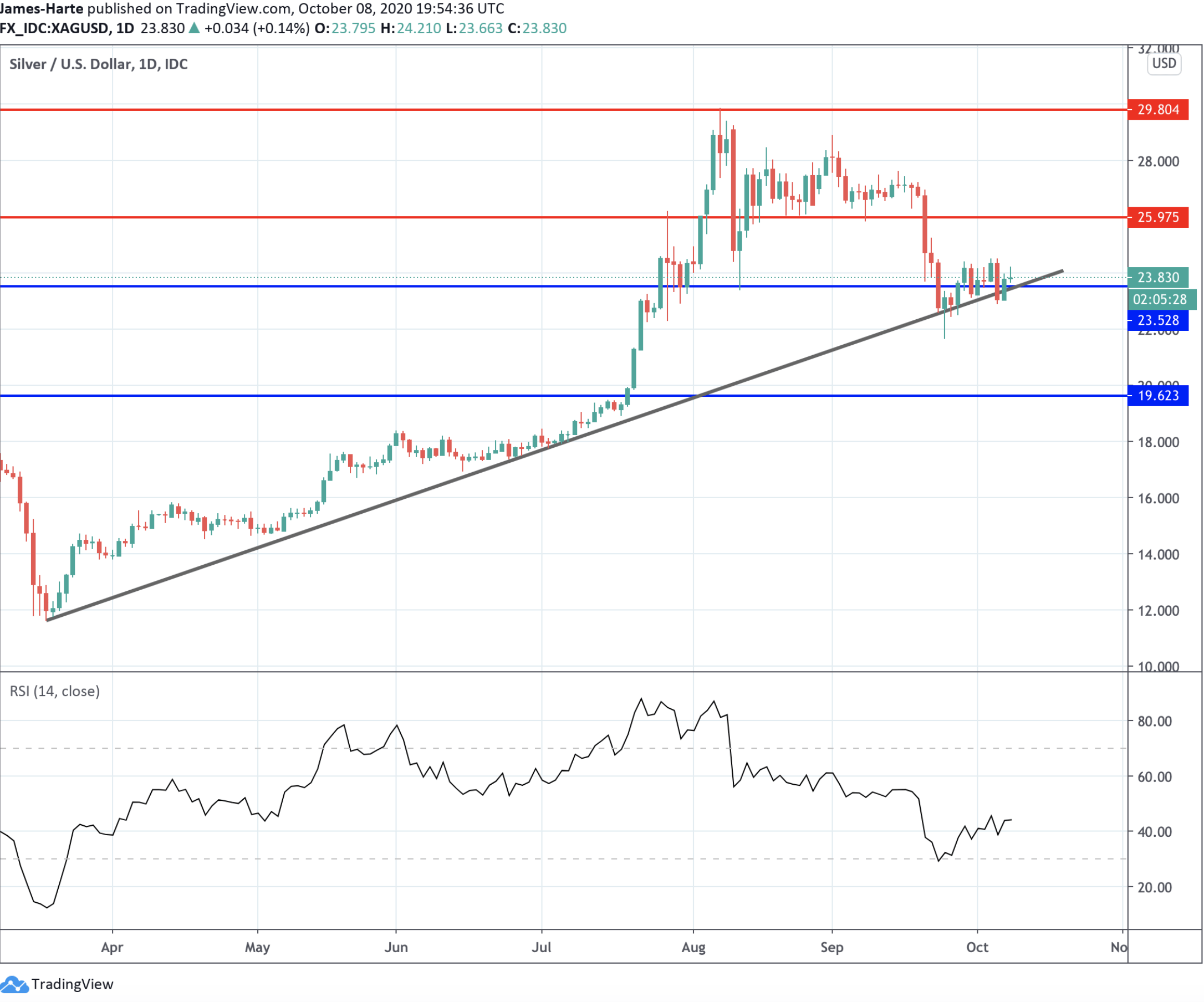

Silver Prices Testing Rising Trend Line

Silver prices continue to find support at the 23.52 level, underpinned by the rising trend line from 2020 lows. While prices holds here, the focus remains on further upside with the 25.97 level the next key resistance to note.

Should price slip back below the trend line, signaling a deeper reversal, the next level to watch will be the 19.62 region.

By Orbex

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024