By Lukman Otunuga, Research Analyst, ForexTime

Monday kicked off on a cautious note as Asian and European markets struggled to shake off the pounding hangover from the brutal selloff on Wallstreet late last week!

Given how there was no specific trigger to the hefty selloff witnessed on the S&P 500 and Nasdaq, most simply labelled it as a ‘healthy pullback’. While this could be the case, it does not change the fact that stock markets have become detached from economic reality.

There was just something troubling about the Pound on Monday. These suspicions were later confirmed on Tuesday onwards after the GBPUSD nosedived over 400 pips thanks to Brexit related drama and uncertainty. Interestingly, FXTM’s trader’s overall sentiment is long on the currency pair as of writing.

As US markets returned from a long weekend break, the reality check of darker nights and party eventually coming to an end started to hit home.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

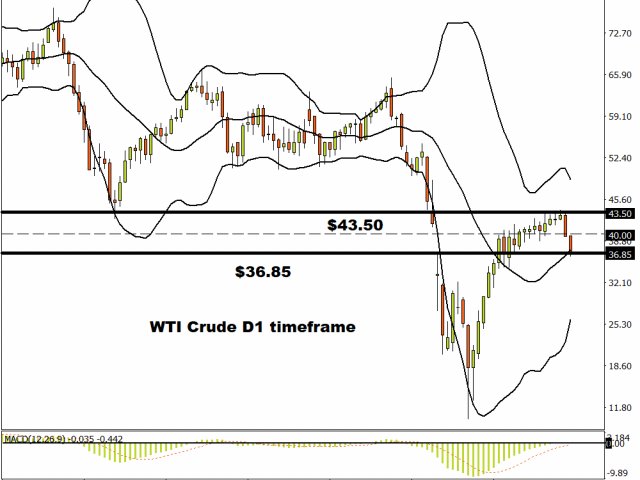

In the commodity arena, Crude Oil retreated below the psychologically-important $40/bbl level thanks to concerns over the waning demand for Oil.

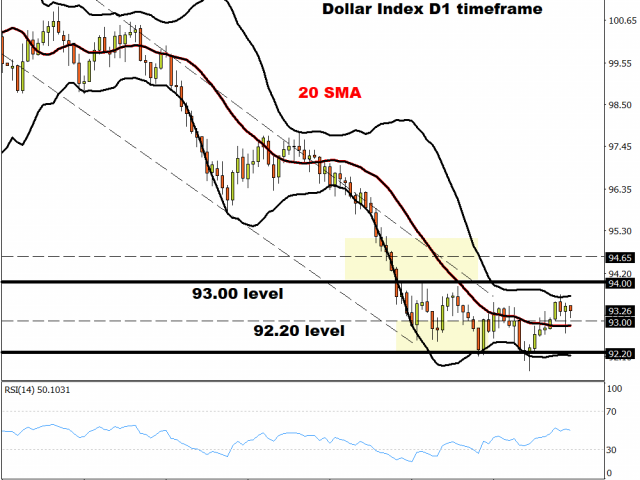

Looking at our mid-week technical outlook, we discussed the possibility of Dollar bulls making a comeback after the Dollar Index (DXY) jumped to a fresh four month high above 93.60. However, gains were later capped by surging Euro which accounts for roughly 57% of the DXY weighing!

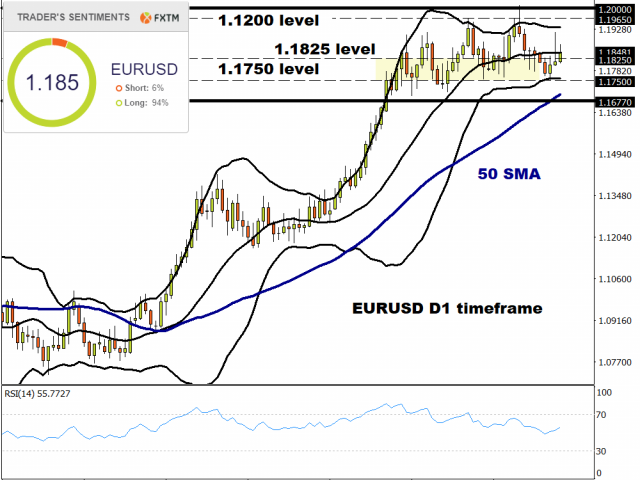

Speaking of the Euro, bulls were injected with a renewed sense of confidence after ECB President Christine Lagarde played down concerns about the euro’s strength.

The Euro has appreciated against every single G10 currency with the EURUSD finding comfort above 1.1815 as of writing. FXTM’s trader’s overall sentiment is long on the currency pair as of writing. Looking at the technical picture, a weekly close above 1.1825 could inspire an incline towards 1.1965.

As the week slowly comes to an end, anyone else wondering whether there will be more bumps ahead for US stocks? Investors are evaluating the prospects of another round stimulus before the November elections while coronavirus cases continue to rise in some major states. With the “Fear Index” (VIX) already punching above 30.00 this month, is this an early warning for turbulence ahead? Time will tell.

Commodity spotlight – Gold

Over the past four weeks, Gold has traded within a wide range with support at $1910 and resistance at $1985.

Regardless of the choppiness, the precious metal remains supported by low-to-negative government bond yields, rising coronavirus cases in the United States and a tired US Dollar. On top of this, the Federal Reserve’s policy shift to let inflation rip may provide Gold a tailwind as interest rates remain lower for an extended period. Additionally, rising inflationary pressures could erode the Dollar’s purchasing power, meaning Gold holds its value while the Greenback depreciates.

Looking at the technical picture, a breakout/down opportunity is in play with $1910 and $1985 acting as key levels of interest. Weakness below $1910 may trigger a drop towards $1890 and $1865, respectively.

Alternatively, a breakout above $1985 may open the doors towards $2000 and possibly $2074.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024