By Orbex

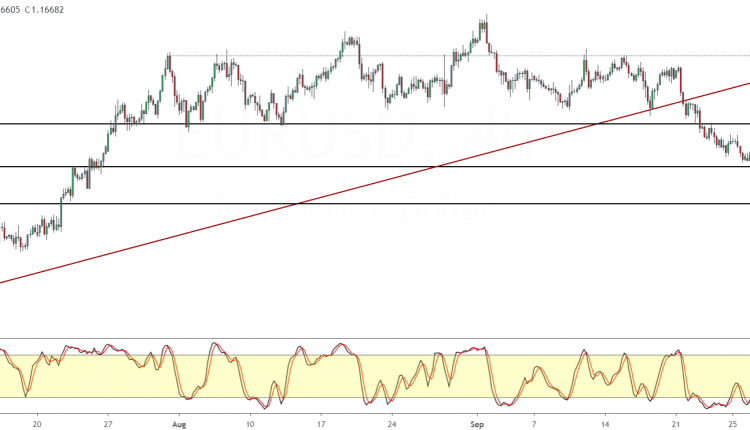

EURUSD Attempts To Pare Losses

The euro is attempting to erase gains from last Friday in what could be a near term correction.

After losing the 1.1900 handle, the EURUSD has been steadily posting a decline.

Price action is somewhat stable, close to the 1.1600 level of support.

The current rebound could see the EURUSD attempting to test the 1.1715 handle. If resistance forms here, we expect to see price eventually breaking down past the 1.1600 level.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Alternatively, a close above the 1.17150 level could potentially see the bullish momentum resuming, putting the EURUSD on track to test the 1.1900 level next.

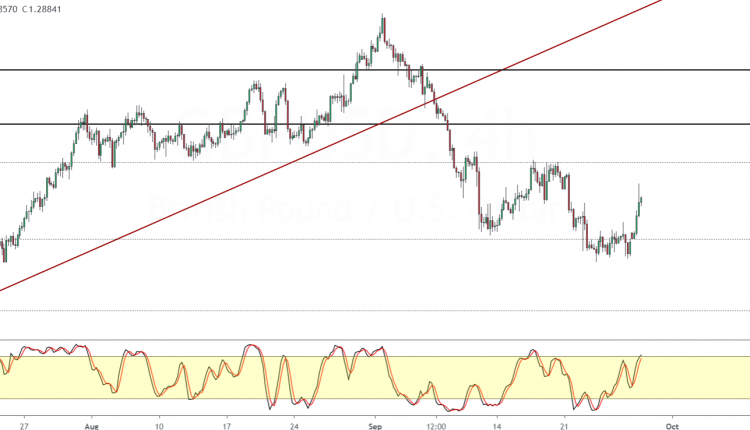

GBPUSD Rises Amid Brexit Talks

The British pound sterling is trading stronger on Monday as price action managed to post a recovery.

This comes after cable-stayed flat since Wednesday last week.

The bullish follow-through after Friday’s doji candlestick pattern suggests some near term upside.

The key level for GBPUSD will be the 1.3000 handle.

A close above 1.3000 could open the way for price to rise to the 1.3035 level next.

In the medium term, we expect GBPUSD to hold steady within the 1.3000 level and the current lows near 1.2700.

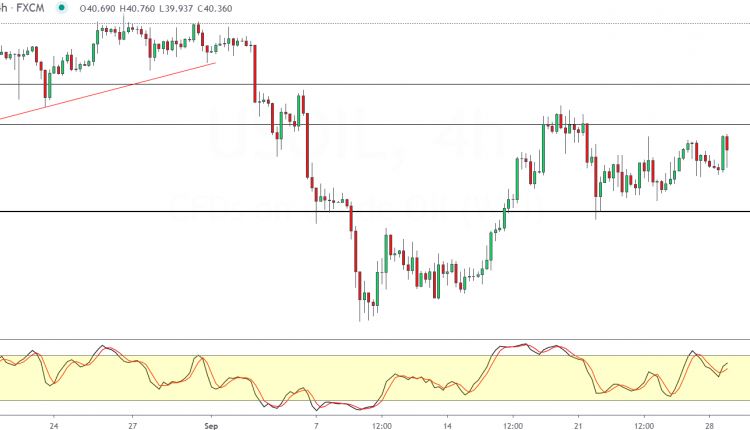

Oil Prices Hold Steady Below 41

WTI crude oil prices continue to trade mixed with price action holding steady below the 41.00 level of resistance.

Monday’s price action marks the fifth session where oil prices have been trading in a range, within the high and lows from last Monday.

A breakout from this range could see the larger sideways range giving way to a stronger trend.

For the moment, watch how the price action unfolds as WTI crude oil approaches the 41.00 level.

Above this level, the 42.00 level will be the next crucial resistance level to break.

As a result, we could expect this sideways range to continue in the near term. There is also a risk that prices could fall back to the 38.83 level, given that the lower support area was not fully tested.

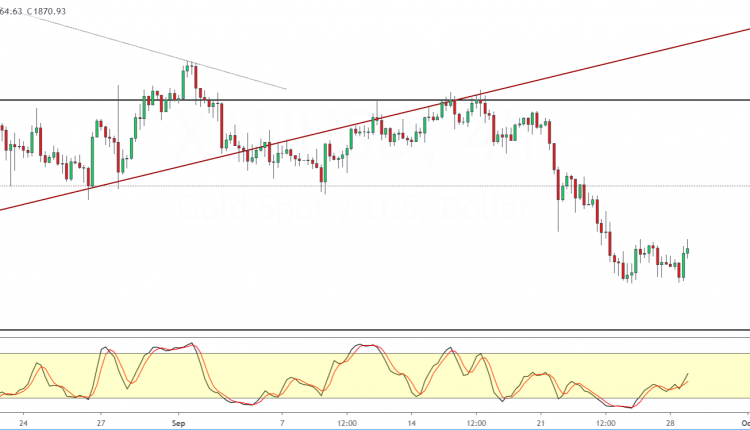

Gold Likely To Trade Flat For 3rd Consecutive Session

The precious metal is caught in a sideways range right after prices fell sharply last week to a two-month low.

Gold prices are currently steady with price action holding up above the 1850 level of support.

The near-term consolidation could lead the way to price making a correction to the upside.

This could see gold prices testing the 1900 -1911 region once again.

As long as resistance holds near this level, we could expect this sideways range to hold in the near term.

However, the bias will shift to the upside if gold manages to break past the 1900 threshold once again.

Meanwhile, the descending triangle pattern continues to hold for the moment, putting the downside target toward the 1750 level of support.

By Orbex

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024