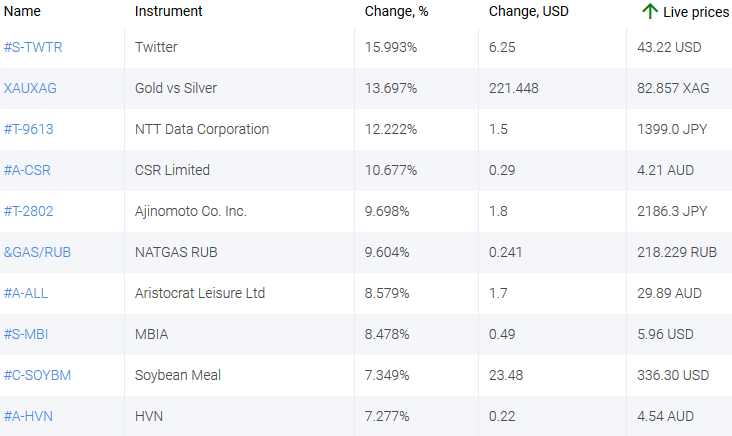

Top Gainers – The World Market

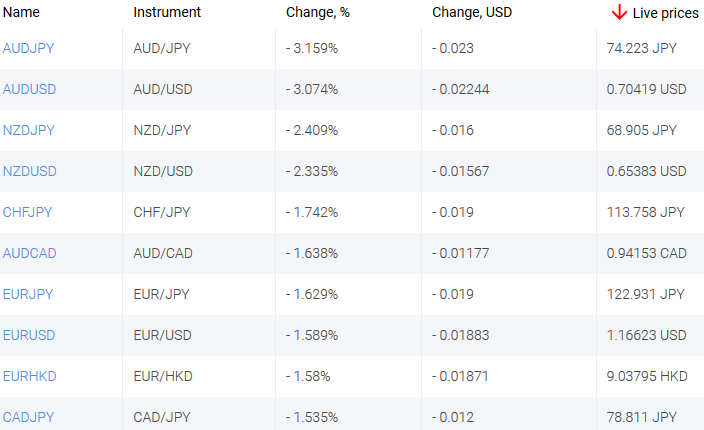

Another aggravation of China-US relations led to the New Zealand and Australian dollars significant decline. China is the main buyer of minerals and agricultural products from Australia and New Zealand. US insists on China’s participation in the Strategic Arms Reduction Treaty (START III). The greenback strengthened due to the Fed’s announcement of a possible rate hike in the future, rather than waiting for inflation to reach the 2% target. The Fed also doubts the need to increase the volume of the current quantitative easing program.

1.Twitter Inc., 16% – an American social network

2. XAUXAG, 13.7% – Gold vs Silver — a gold instrument “Gold vs Silver”

Top Losers – The World Market

1. Goodyear Tire & Rubber Company – an American manufacturer of rubber tires for cars, trucks, buses and other wheeled vehicles

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

2. Rolls-Royce Group plc – a British manufacturer of aircraft equipment and power plants.

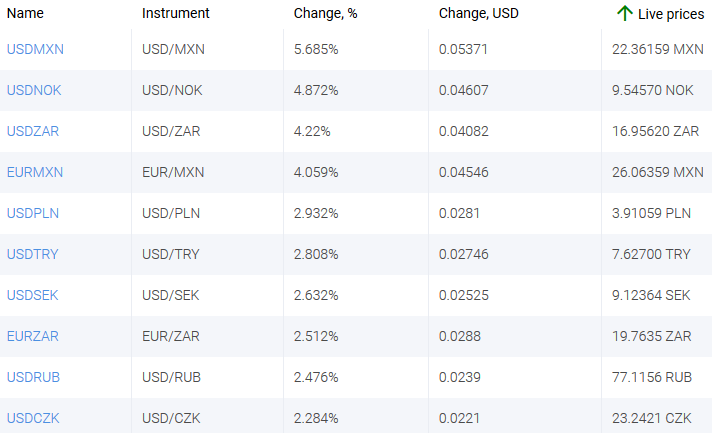

Top Gainers – Foreign Exchange Market (Forex)

1. USDMXN, EURMXN – the growth of these charts means the strengthening of the US dollar and the euro against the Mexican peso.

2. USDNOK, USDZAR – the growth of these charts means the weakening of the Norwegian krone and the South African rand against the US dollar.

Top Losers – Foreign Exchange Market (Forex)

1. AUDJPY, AUDUSD – the drop of these charts means the weakening of the Australian dollar against the Japanese yen and the US dollar.

2. NZDJPY, NZDUSD – the drop of these charts means the weakening of the New Zealand dollar against the euro, the Japanese yen and the US dollar.

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024