By Lukman Otunuga, Research Analyst, ForexTime

The afternoon after the night’s raucous presidential debate has seen US stocks climbing northwards on renewed stimulus optimism. That Democratic challenger Biden ‘survived’ the debate is one takeaway, but transition concerns linger with direct accusations largely outweighing policy discussions, as we wrote this morning.

Economic data has been more encouraging today with Chinese PMIs this morning signalling solid expansion of manufacturing activity as well as the services PMI climbing to the highest level since mid-2012. Notably, new export orders surged with the strongest reading since September 2014.

US employment figures have also been positive with the ADP print of 749k jobs beating expectations of a gain of 600k, with construction and trade transportation leading the gains. The report comes two days ahead of the monthly non-farm payrolls report which is forecast to show growth of 800k in September.

The Dollar is fairly mixed on the day having been bolstered earlier by month-end and quarter-end demand. Nancy Pelosi and Steve Mnuchin are scheduled to meet again today as Democrats look set to schedule a House vote on their $2.2 trillion stimulus proposal.

EUR anxiety building over relief package

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

The Euro is in the red this afternoon following ECB President Lagarde’s concern about low inflation, which comes amid rising speculation over a rate cut. News of a possible delay in the EU Recovery Fund is also definitely not helping EUR bulls.

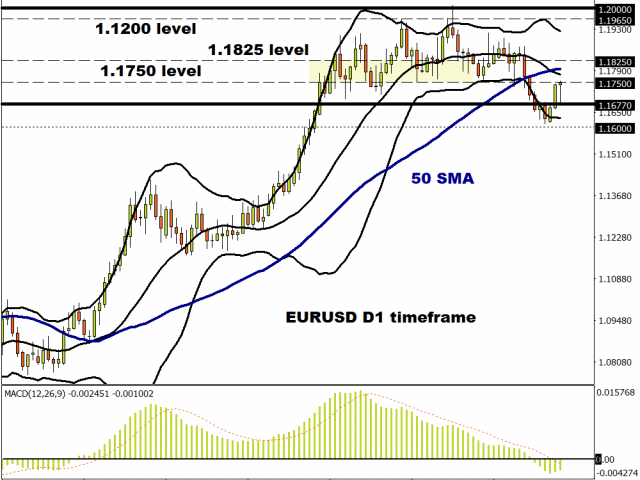

After falling out of its eight-week range recently, the recent advances in EUR/USD have been checked around 1.1750. This area has acted as a pivot point and recent support on numerous occasions since mid-July, so now turns into resistance. The world’s most popular pair looks to be well supported above 1.16.

CAD steady and compressing

The monthly Canadian GDP report showed that the economy recorded growth of 3% in July, lower than the previous month’s 6.5% rise but in line with estimates. At the present pace, Canada’s recovery is not lagging its peers, and this should see CAD outperform AUD and NZD, as it has done so far this month.

This, coupled with a modest uptick in crude oil prices, has extended some support to the commodity-linked loonie. The daily chart is seeing USD/CAD tracking sideways with solid selling interest on gains to the 1.34 area. An elongated bullish wedge could be forming which may see prices break above 1.3420 resistance.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024