Article By RoboForex.com

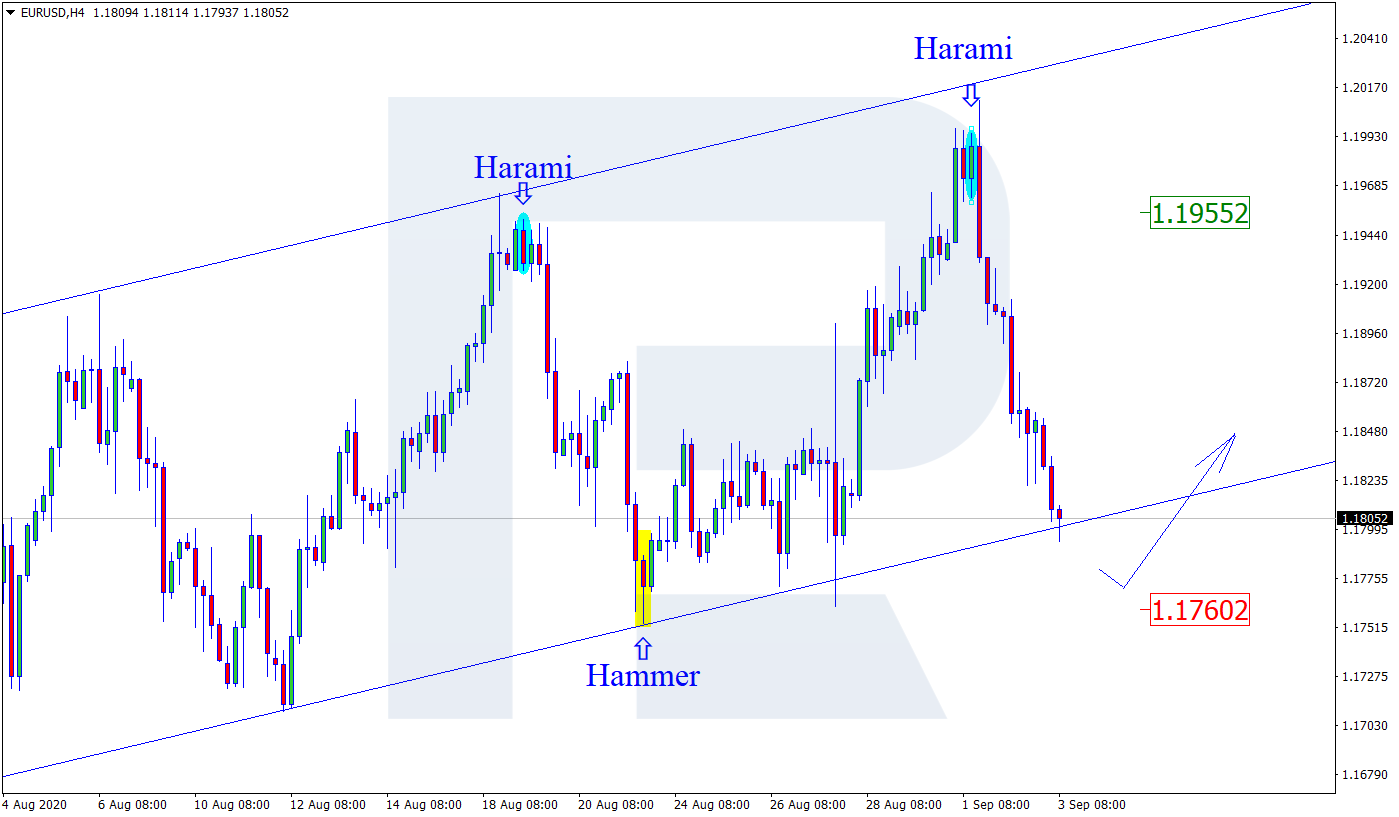

EURUSD, “Euro vs. US Dollar”

On H4, the pair keeps correcting in an uptrend. The price is currently working off a signal by a Harami reversal pattern, testing the lower border of the ascending channel at the moment. Judging by the ascending dynamics, we may suppose that upon correcting, the quotations will bounce off the support line and go on growing to the next resistance level at 1.1955. However, the price may still fall to 1.1760.

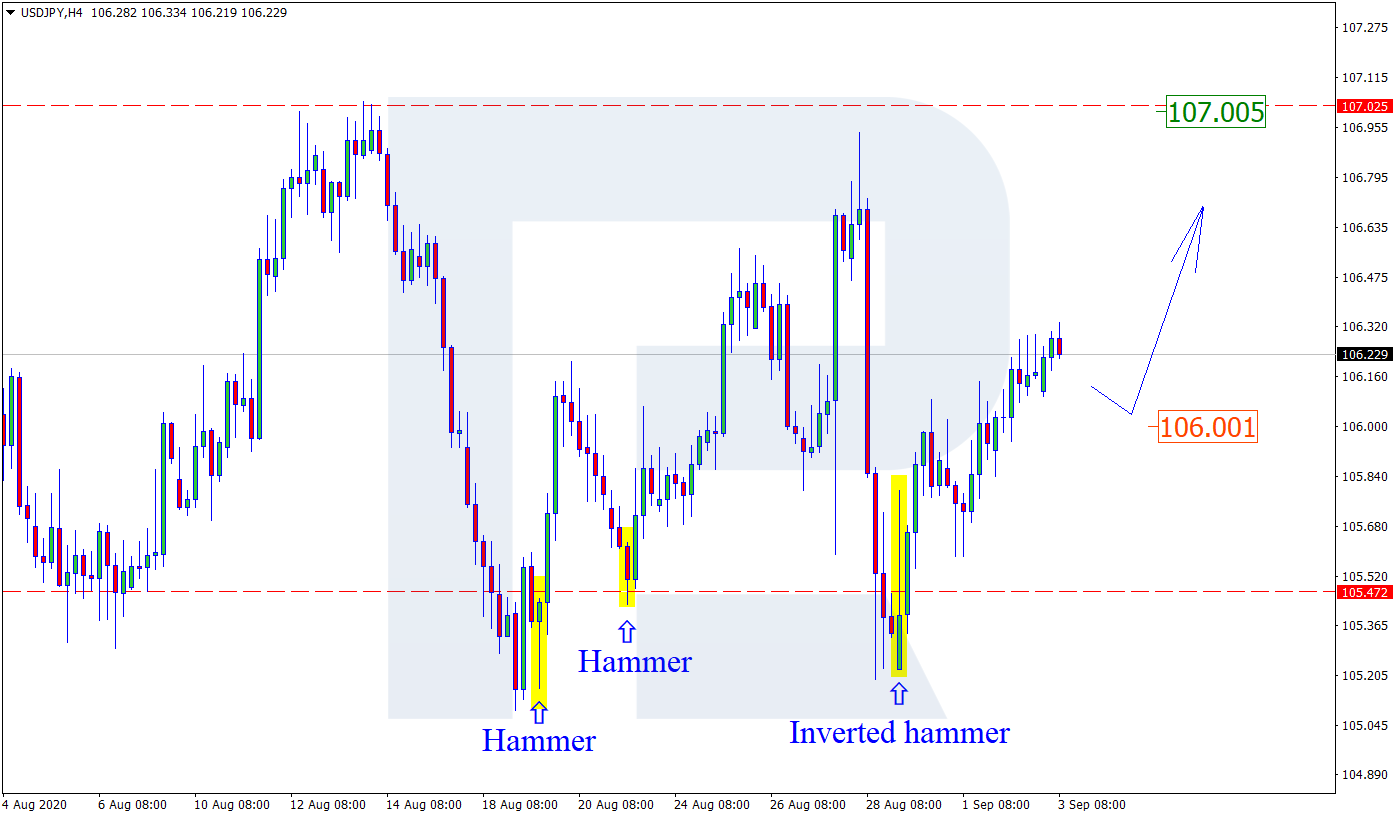

USDJPY, “US Dollar vs. Japanese Yen”

On H4, the pair is working off an Inverted Hammer. We may presume that, upon correcting to 106.00, the pair will go on ascending. The aim of the growth is still near the resistance at 107.00. However, the price may still return to the support at 105.20.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

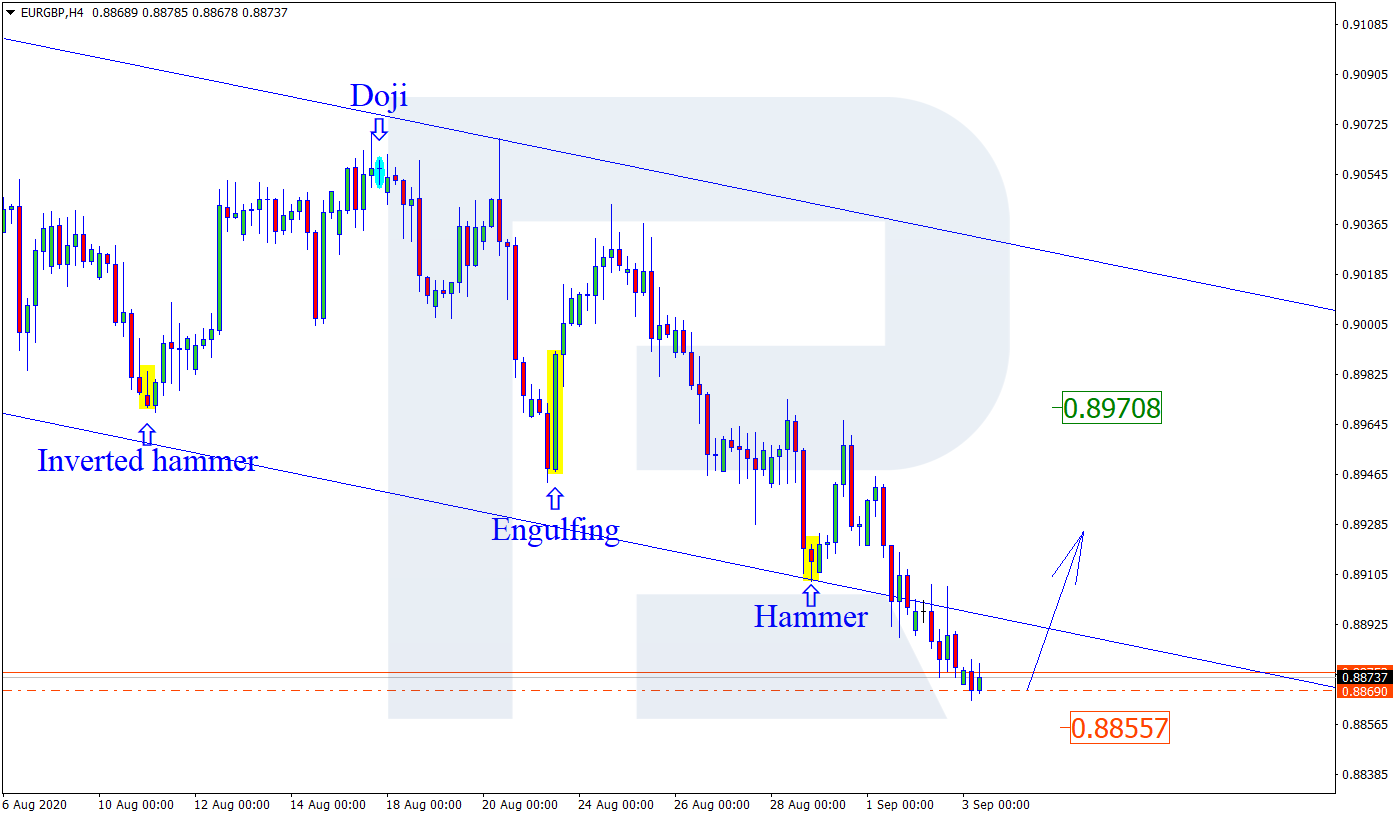

EURGBP, “Euro vs. Great Britain Pound”

On H4, the pair has broken away the lower border of the descending channel. It is currently trading near the horizontal support level, where reversal candlestick patterns might form. The aim of a bounce is currently the resistance level at 0.8970; bouncing, the pair may correct in the downtrend. However, it may still just decline to 0.8855 without correction.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Lean Hogs Apr 20, 2024

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024