Article By RoboForex.com

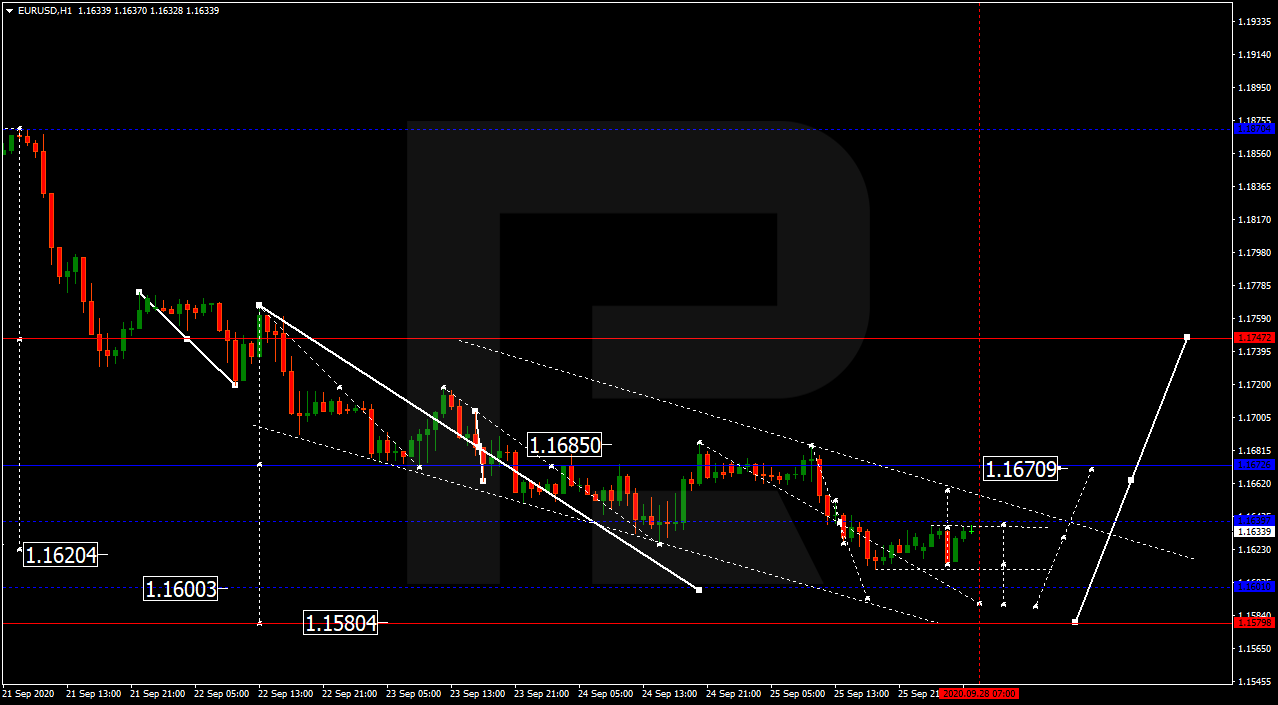

EURUSD, “Euro vs US Dollar”

After breaking 1.1640 and reaching the short-term downside target, EURUSD is expected to grow and test 1.1640 from below. Later, the market may form a new descending structure with the target at 1.1600 and then resume trading upwards to reach 1.1740.

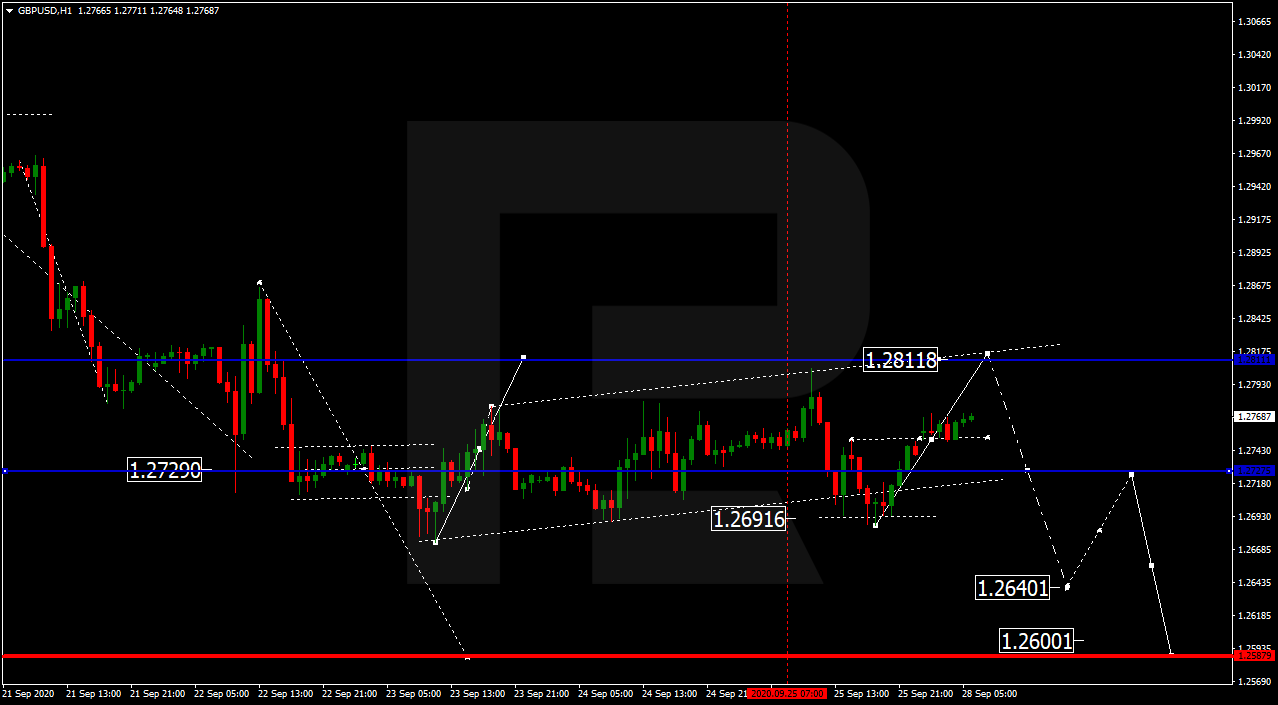

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is still consolidating around 1.2730; it has expanded the range down to 1.2692. Possibly, today the pair may expand the range up to 1.2810 and then trade downwards to reach 1.2690. If later the price breaks this level to the downside, the market may continue moving inside the downtrend with the key target at 1.2600. After that, the instrument may start a new correction towards 1.2870.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

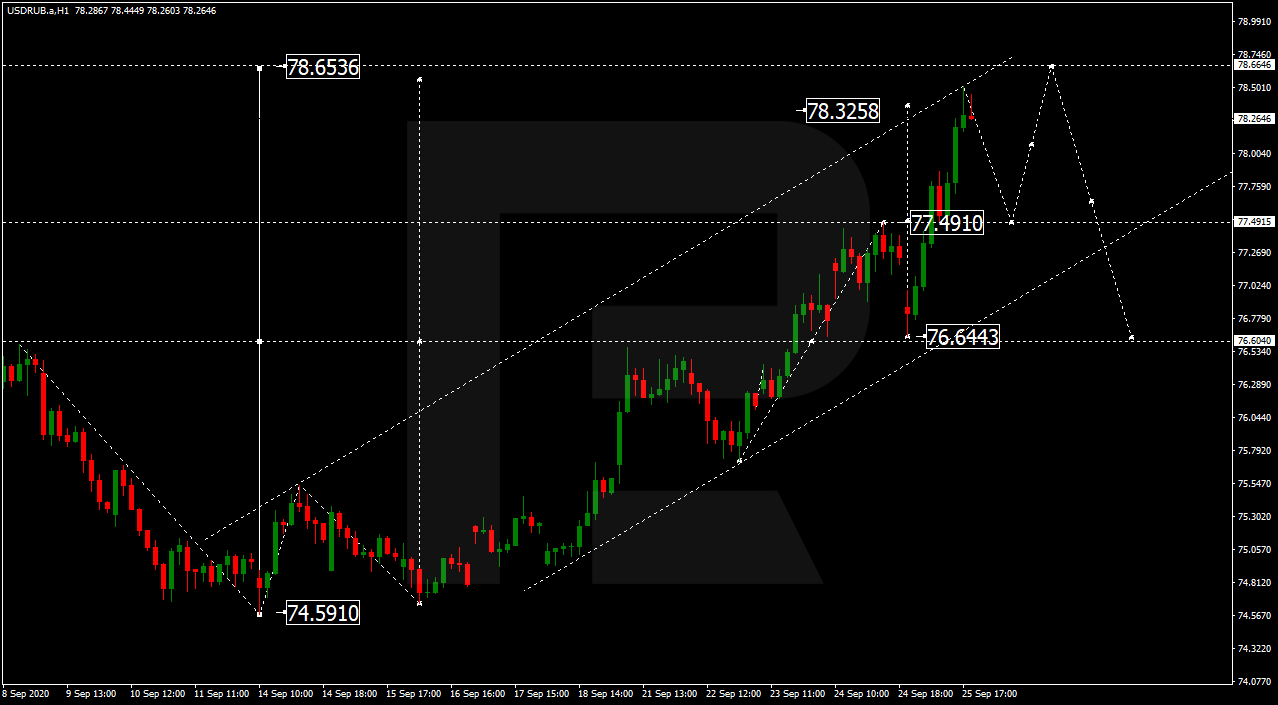

USDRUB, “US Dollar vs Russian Ruble”

After forming another consolidation range below 77.40 and breaking it upwards, USDRUB has completed the ascending structure at 78.32 and may later continue trading upwards. Today, the pair may fall to test 77.50 from above and then start another growth towards 78.70. After that, the instrument may correct with the target at 76.60.

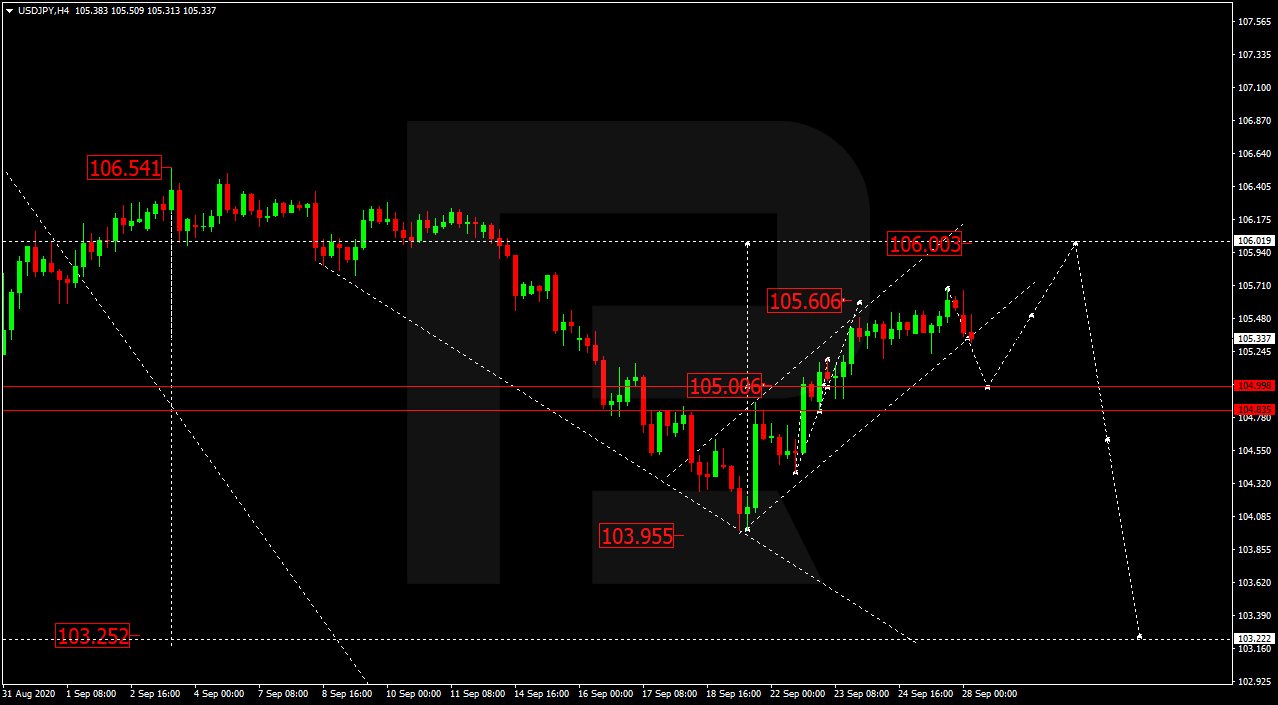

USDJPY, “US Dollar vs Japanese Yen”

After completing the ascending structure at 105.60, USDJPY is falling towards 105.00. Later, the market may form one more ascending structure to reach 106.00 and then start a new decline to return to 105.00.

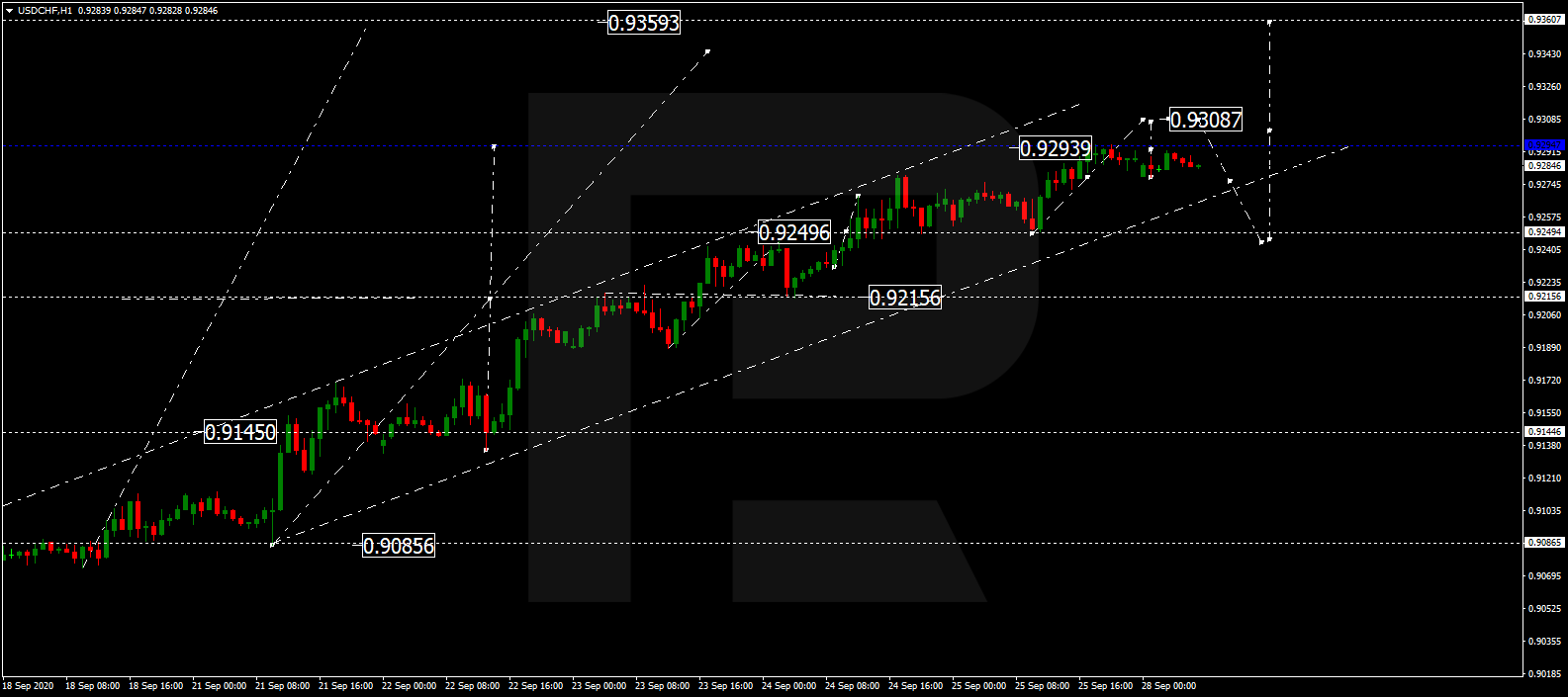

USDCHF, “US Dollar vs Swiss Franc”

After finishing the ascending structure at 0.9292, USDCHF is consolidating below this level. Possibly, the pair may resume moving upwards to reach 0.9308 or even 0.9340. Later, the market may correct with the target at 0.9215.

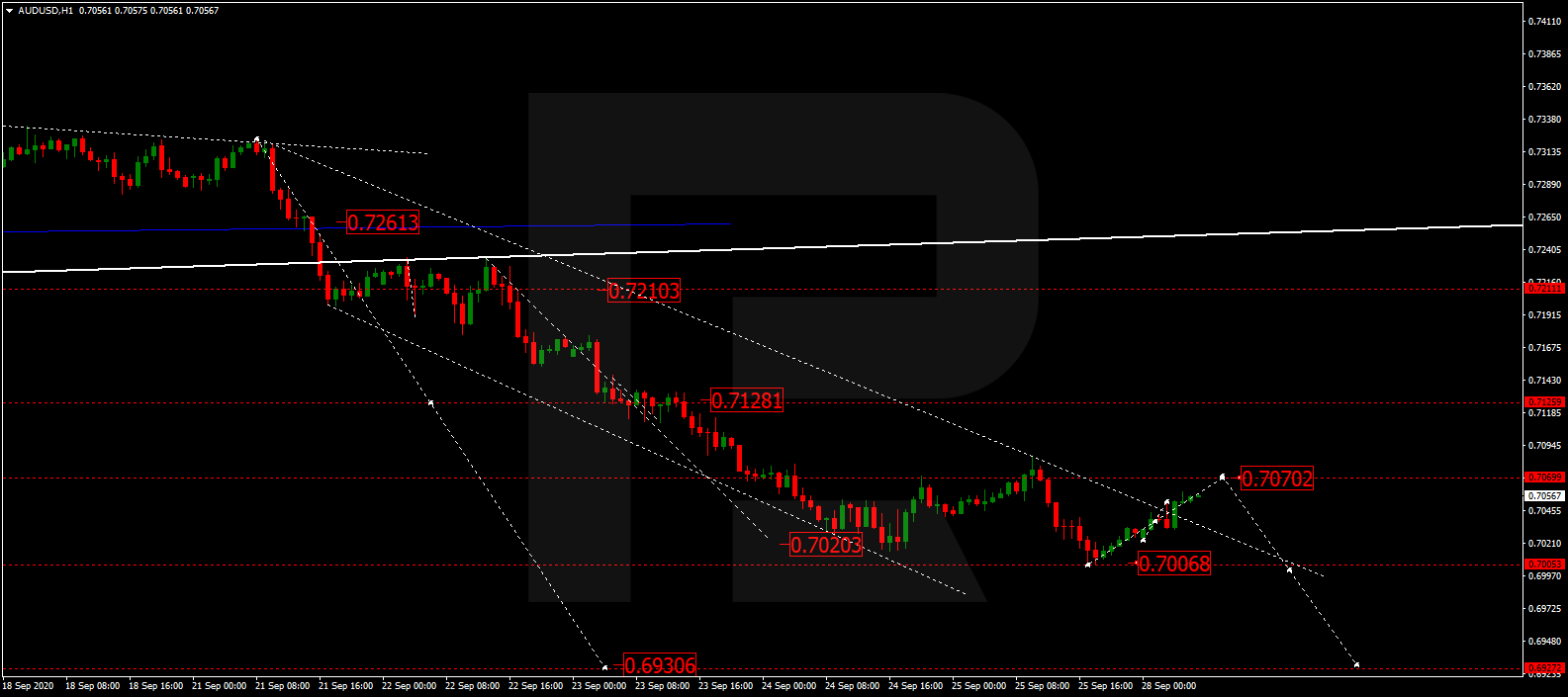

AUDUSD, “Australian Dollar vs US Dollar”

After completing another descending wave at 0.7004, AUDUSD is expected to grow and reach 0.7070. After that, the instrument may resume trading downwards to break 0.7000 and then continue falling with the target at 0.6930. Later, the market may start a new correction towards 0.7240.

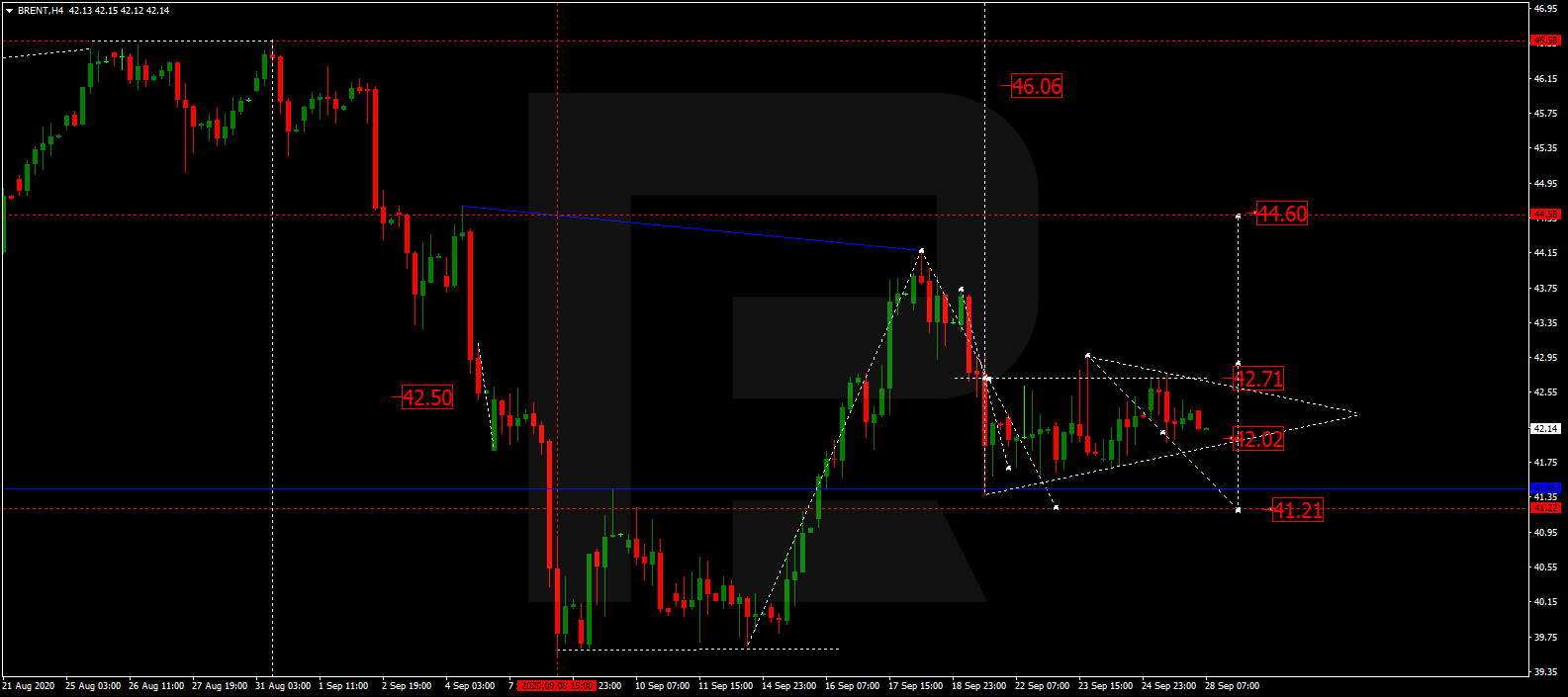

BRENT

Brent is still consolidating around 42.00. Possibly, the asset may expand the range down to 41.20. After that, the instrument may form one more ascending structure to break 42.70 and then continue trading upwards with the target 44.60.

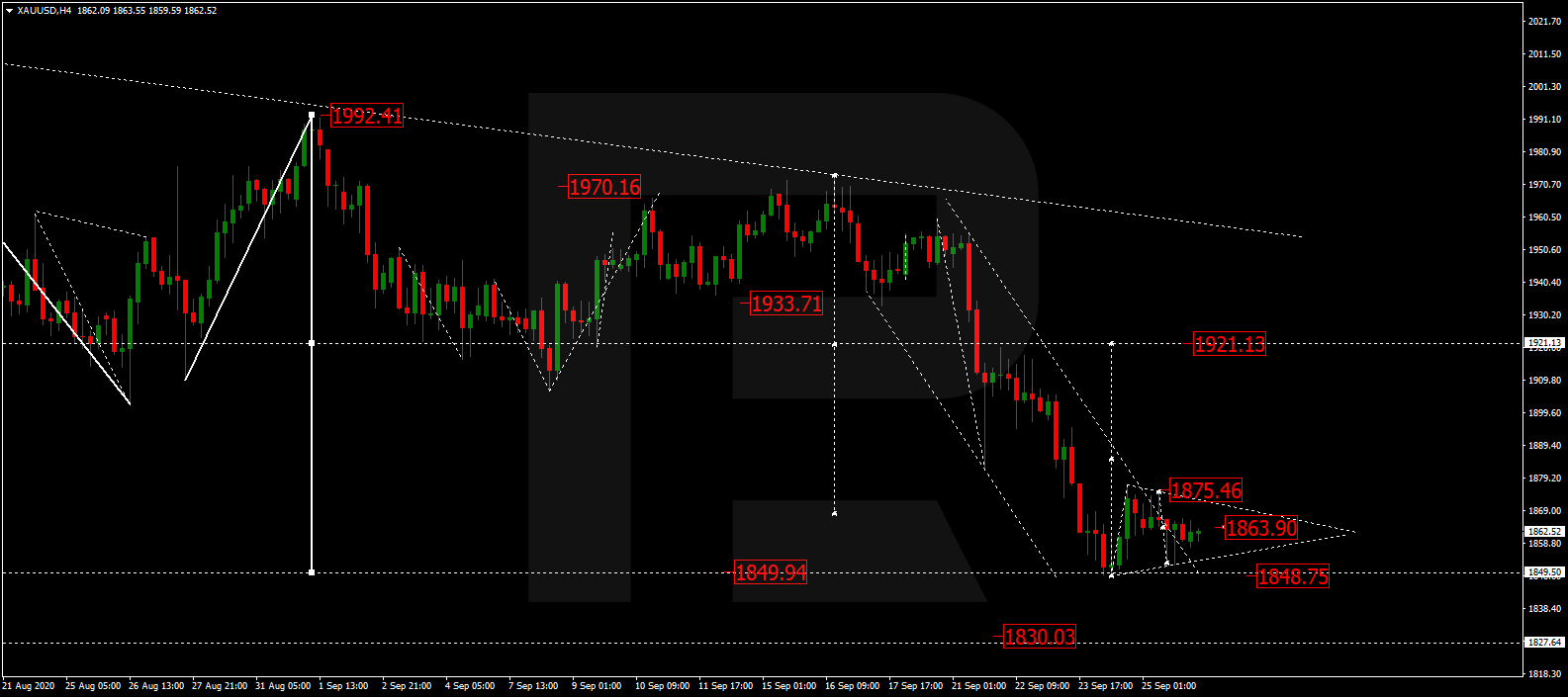

XAUUSD, “Gold vs US Dollar”

Gold is still consolidating at the lows. According to the main scenario, the price may expand the range down to 1848.80 and then start a new growth to reach 1878.50. If later the price breaks this range to the upside, the market may form one more ascending structure towards 1921.15; if to the downside – resume trading within the downtrend with the target at 1830.00.

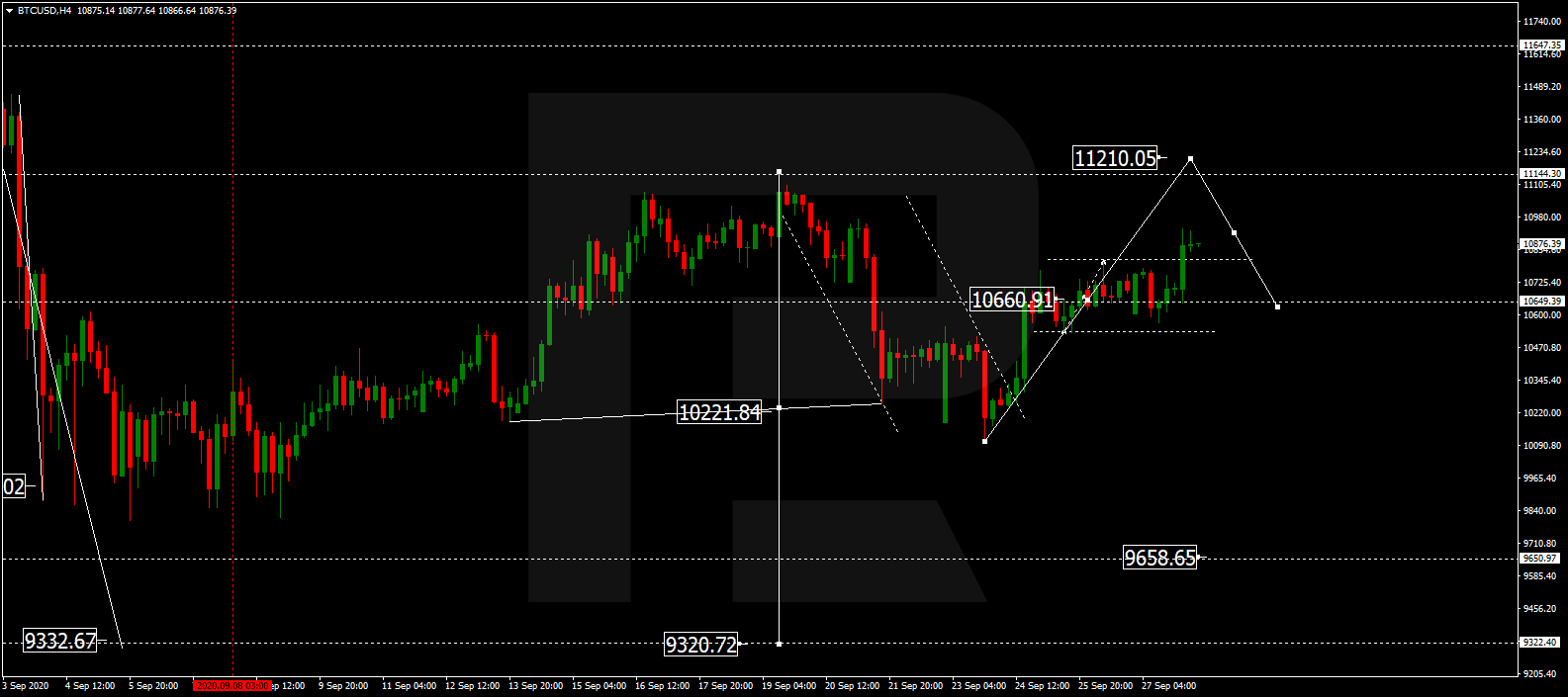

BTCUSD, “Bitcoin vs US Dollar”

After forming another consolidation range around 10660.00, BTCUSD is moving to break it to the upside. Possibly, the pair may extend this structure up to 11200.00 and then resume trading downwards to return to 10660.00. If later the price breaks 10600.00, the market may continue falling with the target at 10000.00 or even 9700.00.

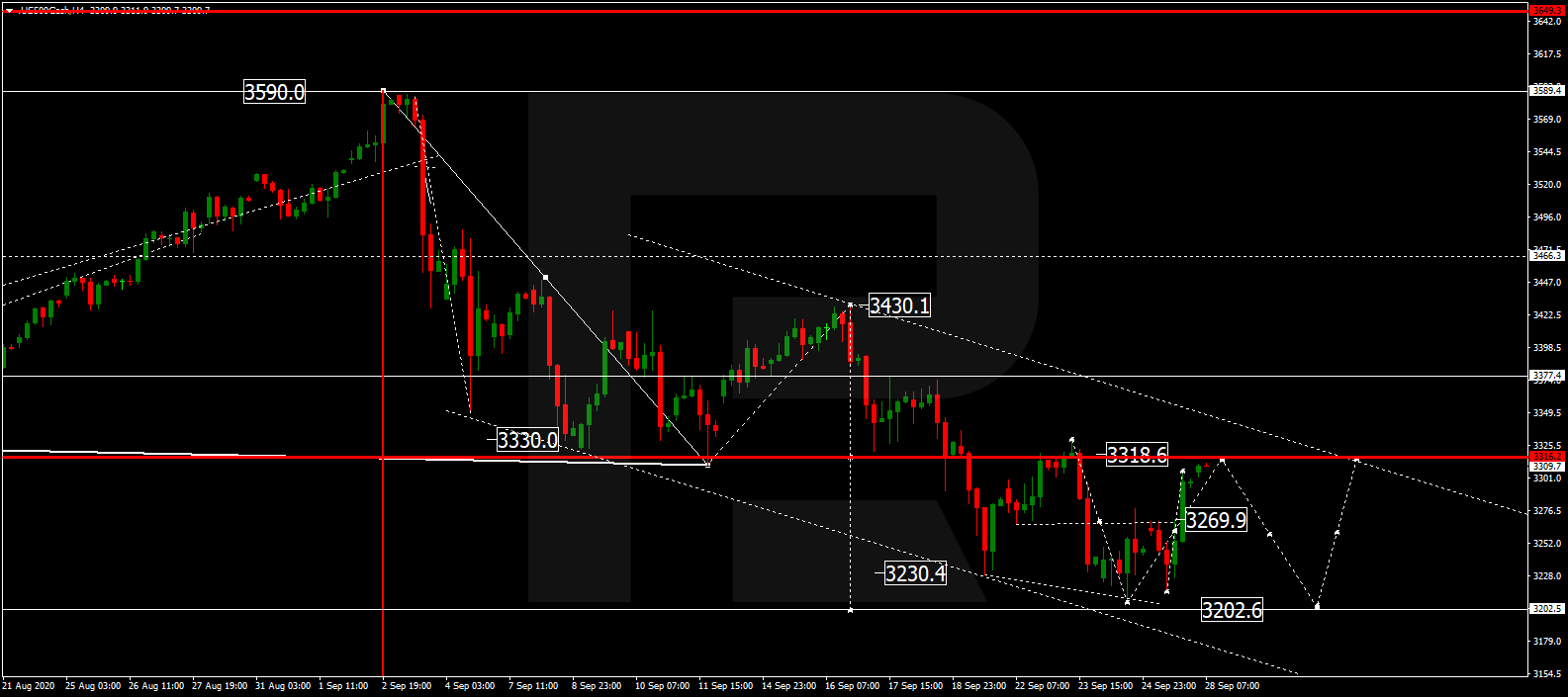

S&P 500

The S&P index is still consolidating around 3269.9 not far from the upside border. Today, the asset may expand the range up to 3330.0 and then start another decline towards 3202.2. After that, the instrument may form one more ascending structure with the target at 3320.00.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024

- US dollar exhibits remarkable strength amid global tensions Apr 15, 2024

- COT Metals Charts: Speculator bets led higher by Copper & Platinum Apr 13, 2024

- COT Bonds Charts: Speculator Bets led by 10-Year & 5-Year Bonds Apr 13, 2024

- COT Soft Commodities Charts: Speculator Bets led by Soybean Meal & Lean Hogs Apr 13, 2024

- COT Stock Market Charts: Weekly Speculator Bets led by VIX & S&P500-Mini Apr 13, 2024

- Singapore’s central bank (MAS) maintained its monetary policy settings. The ECB hinted at a rate cut soon Apr 12, 2024