By Orbex

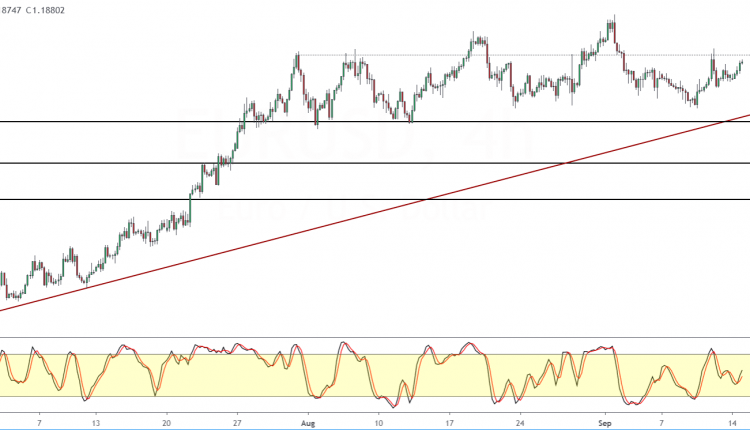

EURUSD Supported Above 1.1800

The euro currency has been trading higher for the most part since the markets opened on Monday.

Price action is on track, inching closer to Friday’s highs. But a close above 1.1900 could confirm further upside in prices.

To the downside, the euro is well supported above the 1.1800 handle.

Temporary support also resides near last week’s lower close of 1.1762.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

For the moment, as EURUSD approaches the 1.1900 handle, it will be critical.

Further gains can come only if there is a strong close above this level.

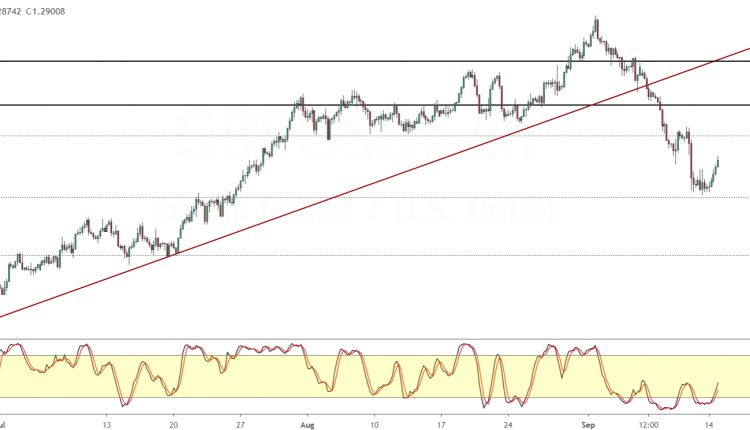

GBPUSD Pares Losses As Price Approaches 1.3000

The British pound sterling is holding a steady pace of gains since last week’s reversal, just near the 1.2800 handle.

With the current bullish momentum, price action could be reaching for the 1.3000 handle next.

But if resistance puts a lid on the gains, then we expect the cable to enter a sideways range within the said levels.

To the upside, a strong close above 1.3000 is required to confirm further gains.

The main key risk for the GBPUSD will be the data-heavy week alongside the BoE meeting later on Thursday.

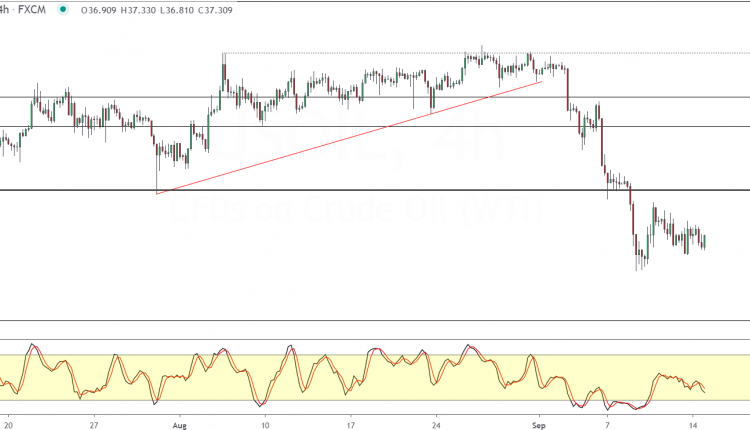

Crude Oil Consolidates Near 37.00

Oil prices are trading soft with price action attempting to pare losses from last week.

Still, prices are hovering near the 37.00 handle.

To the upside, the main resistance is seen at 38.83, while to the downside, last week’s lows near 36.44 forms the line in the sand.

A breakout from either of these two levels could trigger the gains or declines accordingly.

For the moment, a weaker USD is likely helping to keep oil prices supported to the upside.

However, we need to see stronger evidence of higher lows to confirm further gains in the commodity.

Gold Prices Back Near 1967 Resistance

The precious metal is trading stronger on Monday, with gains driven by a weaker USD and the Fed meeting.

Price action is a few points away from the 1967 level which held up as resistance earlier on.

A breakout above this level could give way to further gains, with the next challenge near the 2000 handle.

To the downside, prices are well supported near the 1911.50 region.

The confluence of the trend line and the horizontal resistance could, however, pose a challenge for gold prices in the short term.

By Orbex

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024