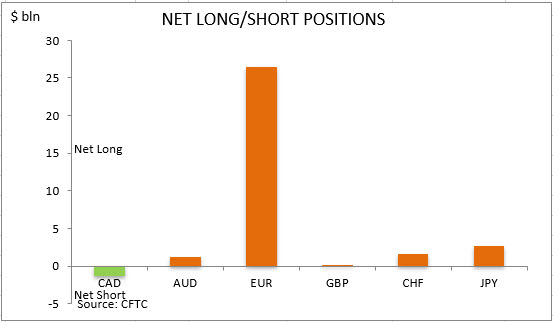

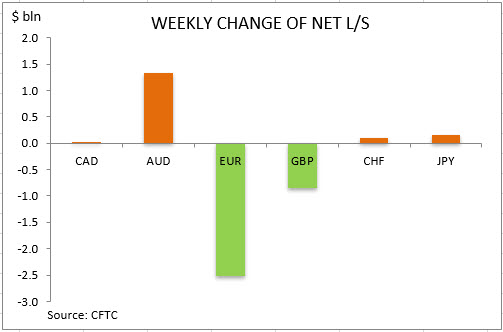

US dollar net short bets decrease speeded up with total net shorts falling to $30.9 billion from $32.67 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to September 15 and released on Friday September 18. The drop in net short dollar bets was the result of mainly decline in bullish bets on euro after consumer prices in Germany continued to decline in August though the disinflation slowed as consumer prices index declined 0.1% over month, in line with forecasts, after 0.5% drop in July. Dollar bearish bets slipped as the Labor Department report showed US consumer price index for August rose 0.4% when a 0.3% growth was expected, while above-expected 884 thousand Americans filed for first-time jobless benefits in the previous week.

CFTC Sentiment vs Exchange Rate

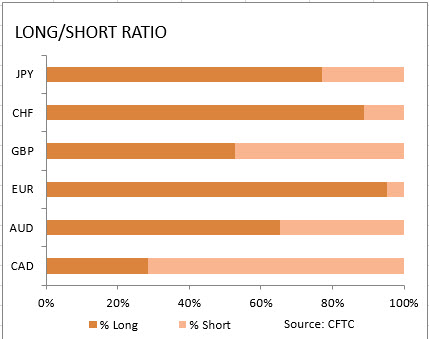

| September 15 2020 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | negative | -1285 | 26 |

| AUD | bullish | negative | 1183 | 1330 |

| EUR | bullish | negative | 26445 | -2516 |

| GBP | bullish | negative | 185 | -848 |

| CHF | bullish | negative | 1661 | 91 |

| JPY | bullish | positive | 2714 | 149 |

| Total | 30903 |

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

- FastSpring and EBANX Forge Partnership to Expand Pix Payments for Digital Products in Brazil Apr 25, 2024

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024