Author: Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday, August 10th, the major currency pair is trying to strengthen but markets aren’t too active so far.

The statistics on the US employment published last Friday helped the USD to recover a little bit and this positive factor is still working for the “greenback”. For example, the Unemployment Rate dropped to 10.2% in July after being 11.1% in June and against the expected reading of 10.5%. The Non-Farm Employment Change showed 1.763M against market expectations of 1.53M.

The Average Hourly Earnings in the USA added 0.2% m/m in July, which is much better than the expected reading of -0.5% m/m.

It goes without saying that the labor market is still trying to rebound after major stress but it’s already clearly seen that the creation of new jobs will require as much as effort as it takes.

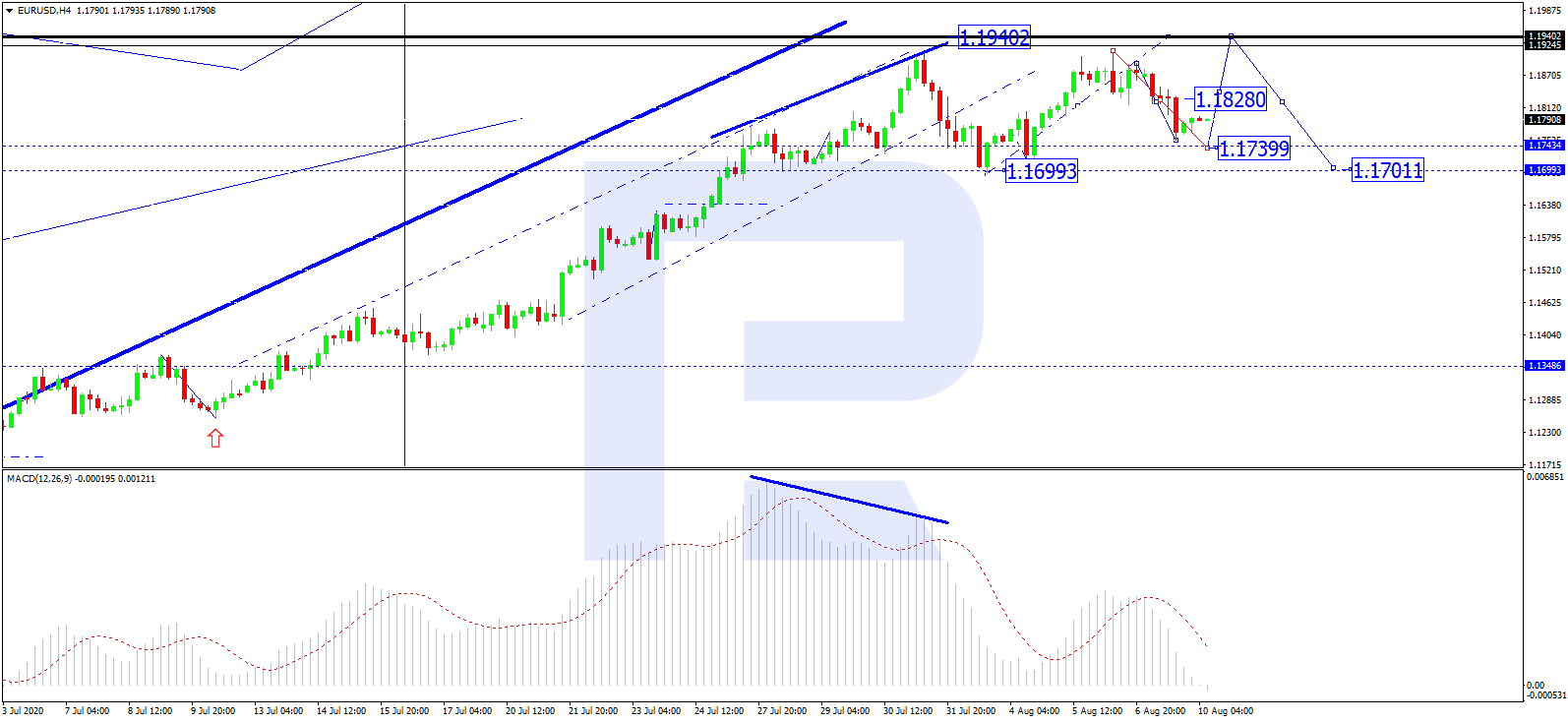

In the H4 chart, EUR/USD is correcting downwards to reach 1.1740 and may later form one more ascending wave with the target at 1.1940. After that, the instrument may start a new decline to 1.1700. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving downwards outside the histogram area, thus indicating a correction on the price chart.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

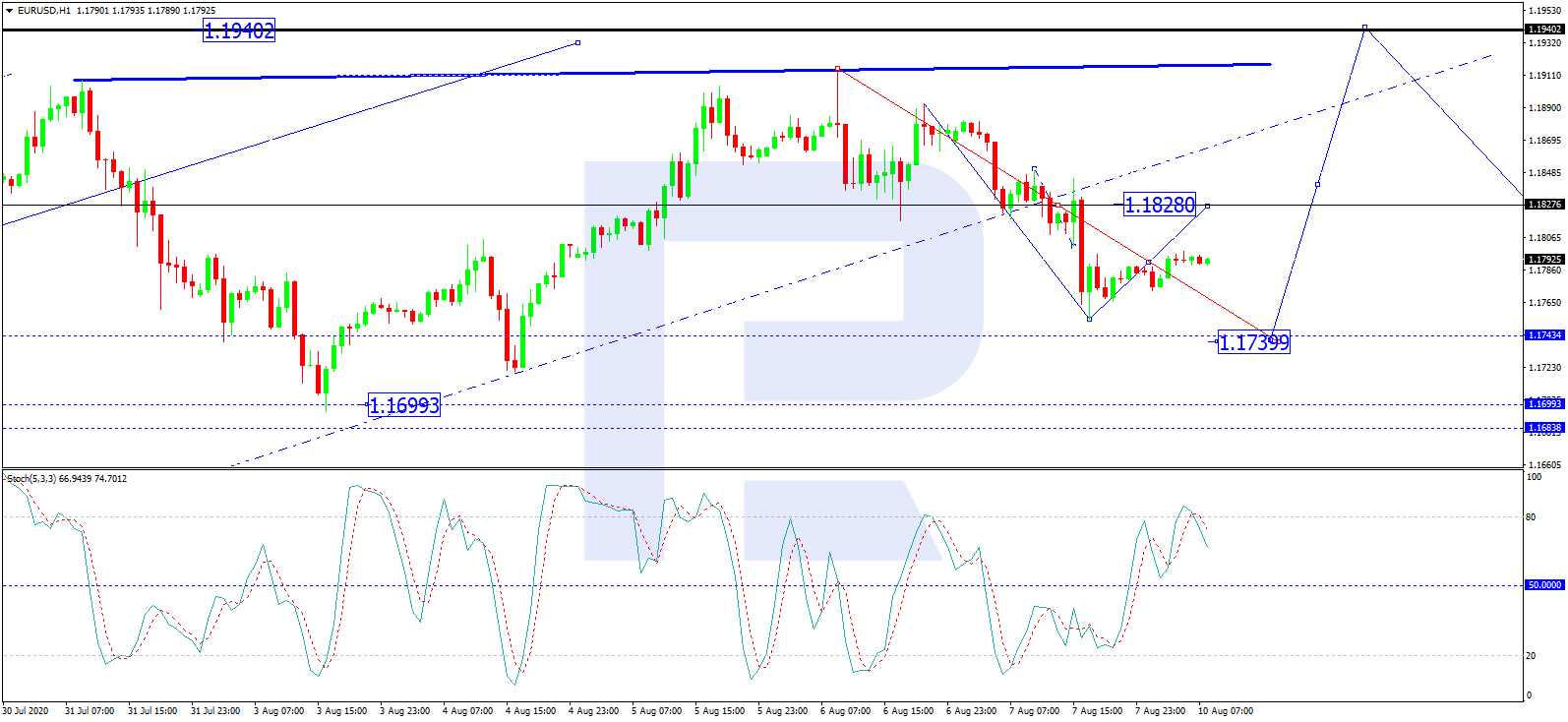

As we can see in the H1 chart, after forming a consolidation range at 1.1828, which may be considered as a downside continuation pattern and a correctional wave, and breaking it to the downside, EUR/USD is expected to resume trading upwards to return to 1.1828. After that, the instrument may continue the correction with the target at 1.1740. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: after rebounding from 80, its signal line is moving downwards. In the future, the indicator is expected to reach 50 and then may return to 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024