By Orbex

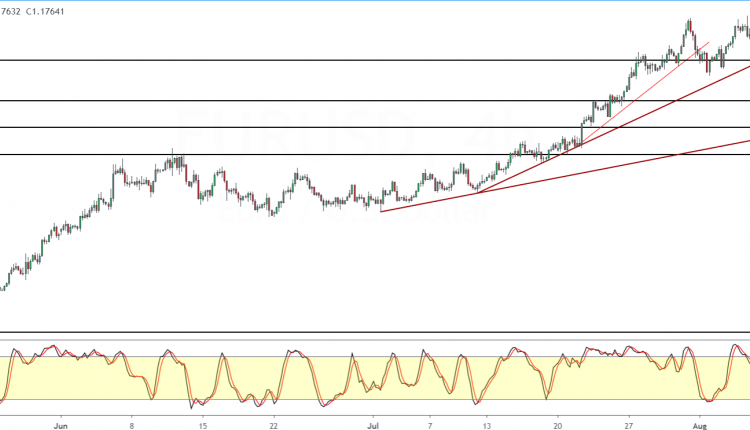

Euro Continues To Extend Declines

The common currency is trading weaker on Monday’s open, extending on the declines from last Friday. This comes as price failed to breach the previous two-year highs.

The dollar strength is also adding to the current weakness in EURUSD. Price action is trading near the 1.1750 level of support.

From the Stochastics oscillator, there is a possibility that EURUSD might hold on to this support.

A rebound off this level could see another attempt to the upside.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

But in case the euro slips below the 1.1750 handle, then we could expect a move toward the 1.1600 level of support next.

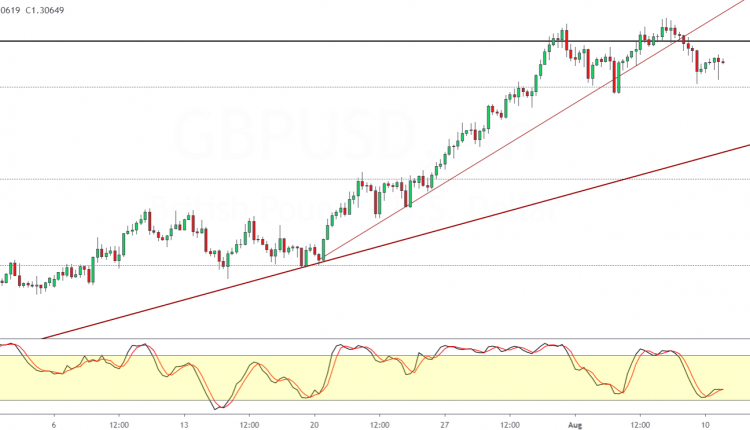

GBPUSD Likely To Settle Inside The Range

The British pound sterling is also extending losses from last Friday. Just after price made another attempt to close above 1.3122, GBPUSD dropped lower.

For now, price action is likely supported near the 1.3000 level. We expect some ranging price action to extend within these levels.

Only a breakout from the range will determine the near term direction. GBPUSD could be poised to breakout higher given the bullish momentum,

A strong close above 1.3122 is required with follow-through to post a new high. The next main target is 1.3200.

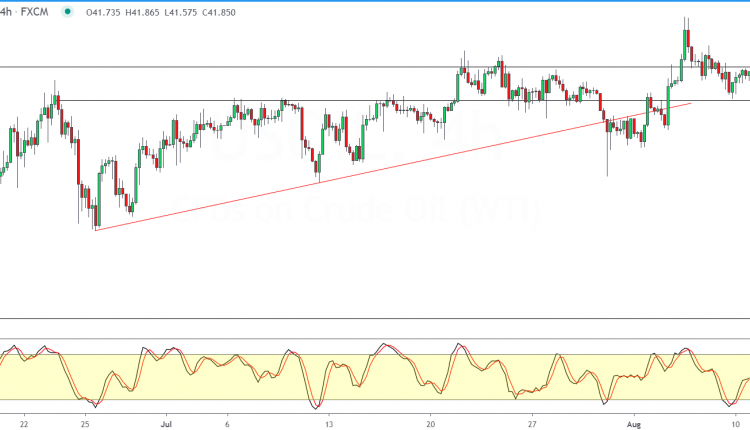

WTI Crude Oil Falls Back Into Consolidation

Oil prices have been somewhat volatile over the past few sessions.

After trading strongly above the 42.00 level, oil prices gave way, paring gains. As a result, WTI crude oil is now trading within the 42.00 and 41.00 levels.

A breakout from this range needs to be convincing in order to maintain the trend.

While the bias remains to the upside, we could expect this sideways action to prevail.

To the downside, below the 41.00 handle, the previous lows near 39.00 might act as support.

To the upside, 43.00 forms the key resistance level.

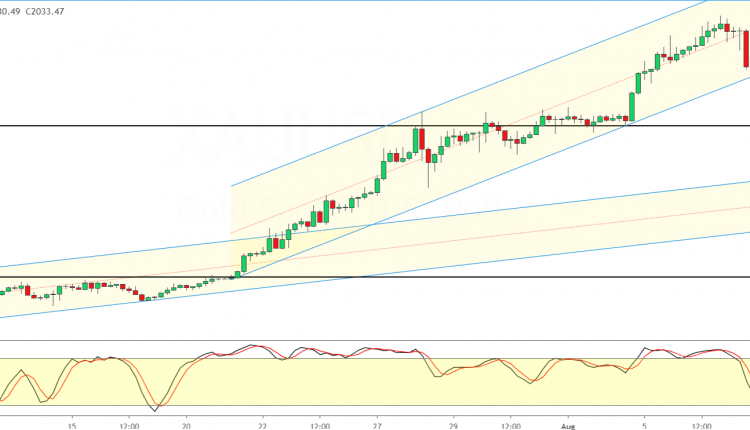

Gold Retreats From All-Time Highs

The precious metal is trading soft on Monday right after prices touched a new all-time high last Friday.

The pace of declines is, however, limited. This means that the upside is still likely to prevail.

On the 4-hour chart, we see that price action is supported by the lower end of the rising price channel.

A rebound off this line will need to see gold prices making higher highs.

Failure to post new gains could potentially put the precious metal at risk of a correction.

Immediate support is near the 1967 handle if the psychological support area near 2000 gives way.

By Orbex

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024