By Lukman Otunuga, Research Analyst, ForexTime

US Treasury yields are continuing to fall with the lowest 10-year yields ever seen, aside from the flash-crash spike low on March 9. Stocks, as usual, are fairly non-plussed with US futures showing a mild dip into the red while alternative assets like gold are holding their ground as bullion consolidates near its recent multi-year highs.

The S&P 500 closed within 3% of its all-time high on Monday and no matter what headwinds are prevailing, the index keeps ploughing on ever higher. TikTok headlines continue to ratchet up US-Sino tensions while a string of poor earnings illustrates the ongoing hit from the pandemic, with jittery investors awaiting news on whether the fresh fiscal stimulus in the US will get approval. As the fiscal cliff gets near and the pandemic’s spread into sunbelt states begins to affect economic activity, it only seems to be the fixed income market which is hunkering down and taking any note of a world slipping into a Covid-19-fuelled recession.

Overnight, the RBA left rates unchanged as expected and announced it would need to buy more bonds in order to keep its three-year bond yield around its target of 0.25%. The policy statement also showed that the AUD rally wasn’t a significant worry to the bank, and this has left the currency fairly flat on the day.

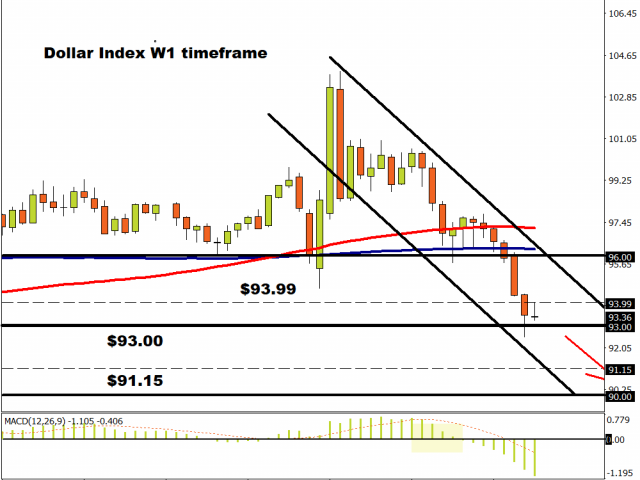

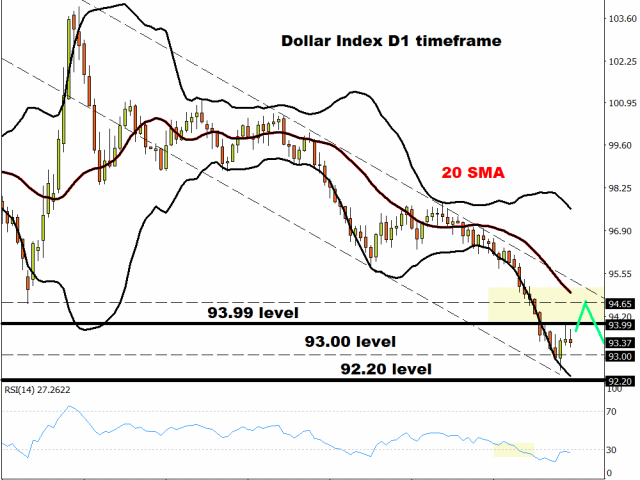

DXY perched on long-term support

After experiencing the worst month in a decade, the oversold king dollar has been endeavouring to find a bid over the last few sessions. August tends to see modest USD upside and the long-term trend line from 2011 appears to be offering support for now. In addition, there seems to be an ever-increasing amount of questions about the long-term role of ‘king’ dollar while the bearish bets are at their largest since April 2018.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Falling yields are not a good sign for longer-term support as better returns lie elsewhere in the world. For now, prices need to get above yesterday’s high at 93.99, before a retaking of the March low at 94.65 can be considered.

Gold hits $2000 but consolidation in the pipeline

It’s simple! Gold is overbought on a technical level but the fundamental conditions for holding the shiny metal are abundant. ‘Lower for longer’ rates, safe haven appeal and dollar weakness are all well-known reasons for gold bugs glee in higher prices. Interestingly, speculator’s net long positions are still some distance away from record levels seen last year, even though ETF tonnage is rising to new record highs.

Current consolidation constitutes healthy price action after such strong gains as this eases overbought conditions. Round number resistance is always tough to beat initially as well, so profit-taking around $2,000 is to be expected. Beyond here lies resistance at $2,040 and $2,100.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024