By Lukman Otunuga, Research Analyst, ForexTime

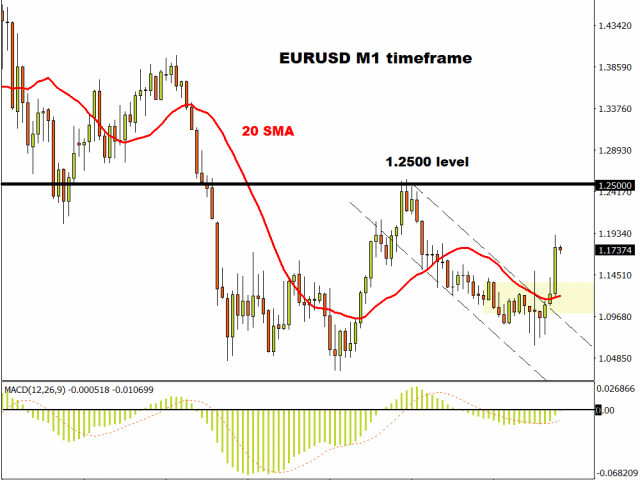

After appreciating more than 4% against the Dollar since the start of July, it looks like the Euro may be tired and ready for a well-deserved retracement over the next few days.

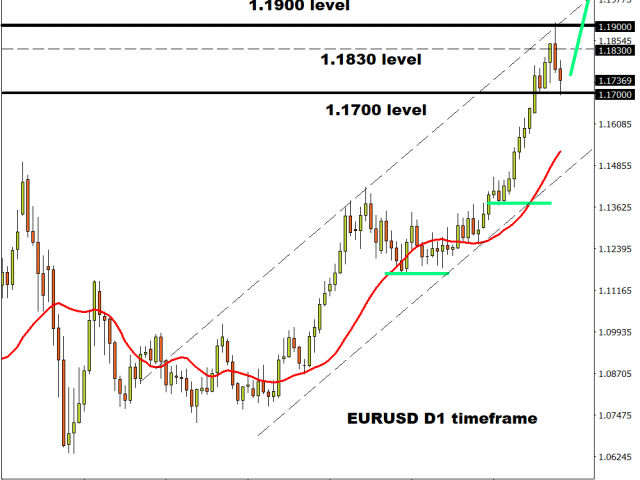

The Euro has stood its ground against most G10 currencies thanks to stabilizing economic fundamentals, falling number of reported coronavirus cases in Europe and EU leaders approving an unprecedented $2.1 trillion coronavirus relief budget. Given how the fundamentals are slightly favouring the Euro and the Dollar weakening to a growing list of negative factors, the medium to longer-term outlook for the EURUSD points north.

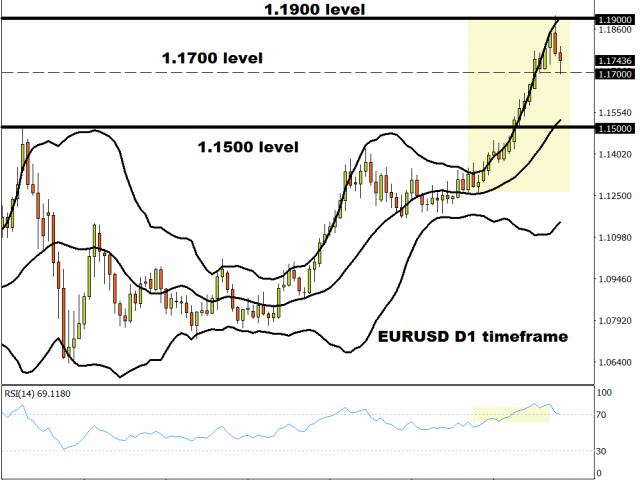

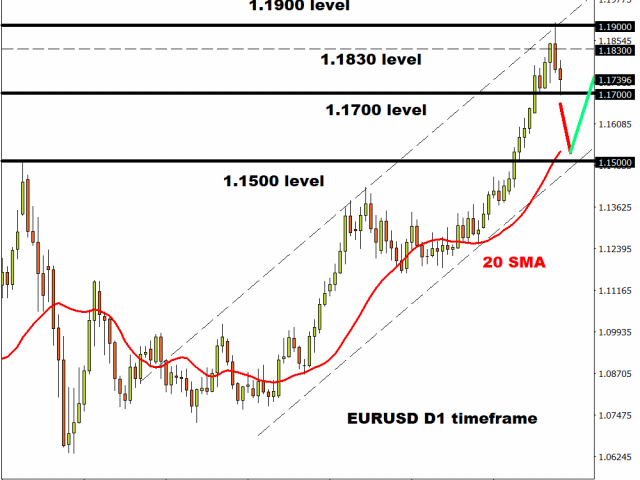

However, prices look heavily overbought in the short term with bears already making an appearance as August kicks off. The candlesticks are hugging the outer skin of the Bollinger bands while the Relative Strength Index is in overbought territory above 70.0. Where the EURUSD concludes this week will be heavily influenced by how prices behave around the 1.1700 support level.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Should this level prove to be reliable support, bullish investors could be given the green light to propel the EURUSD back towards 1.1830 and beyond.

Alternatively, a breakdown below 1.1700 may trigger a steeper pullback towards 1.1500 before the EURUSD continues its journey north.

On the data front, keep a close eye on the ZEW Indicator of economic sentiment for the Euro Area scheduled for released on Tuesday morning. Euro Industrial production data on Wednesday and the second estimation of Q2 GDP which will be published on Friday. With the Euro still sensitive to economic data, the pending reports will certainly play a role in where the currency pair concludes this week.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024