Article By RoboForex.com

GOLD

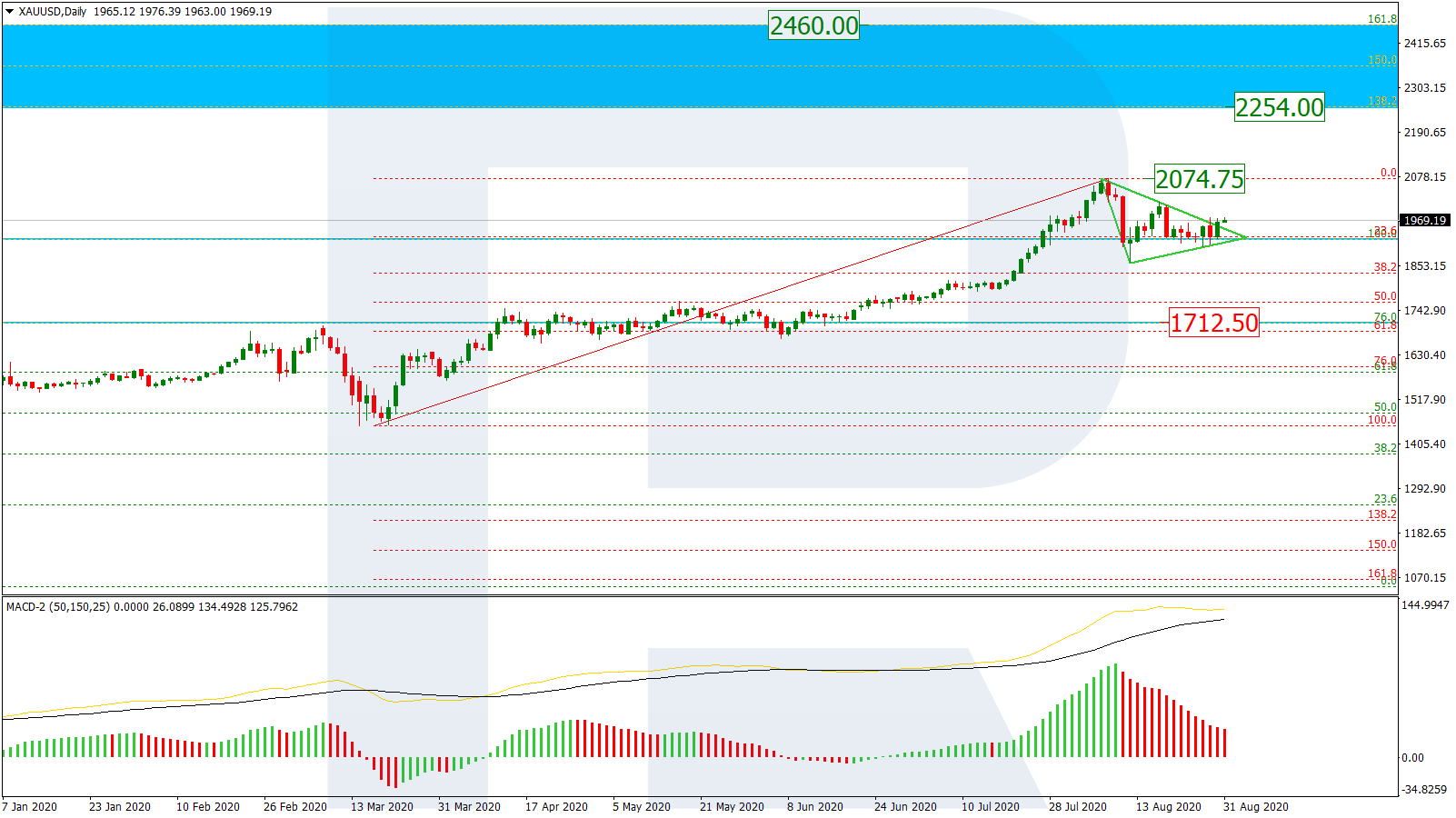

On D1, the quotations declined to the previous important level of 1920.66 USD. The correction now looks like a Triangle. The pair may go on declining to 1712.50 USD. After the end of the pullback, the growth will continue in the range between 138.2-161.8% Fibo (2254.00-2460.00 USD).

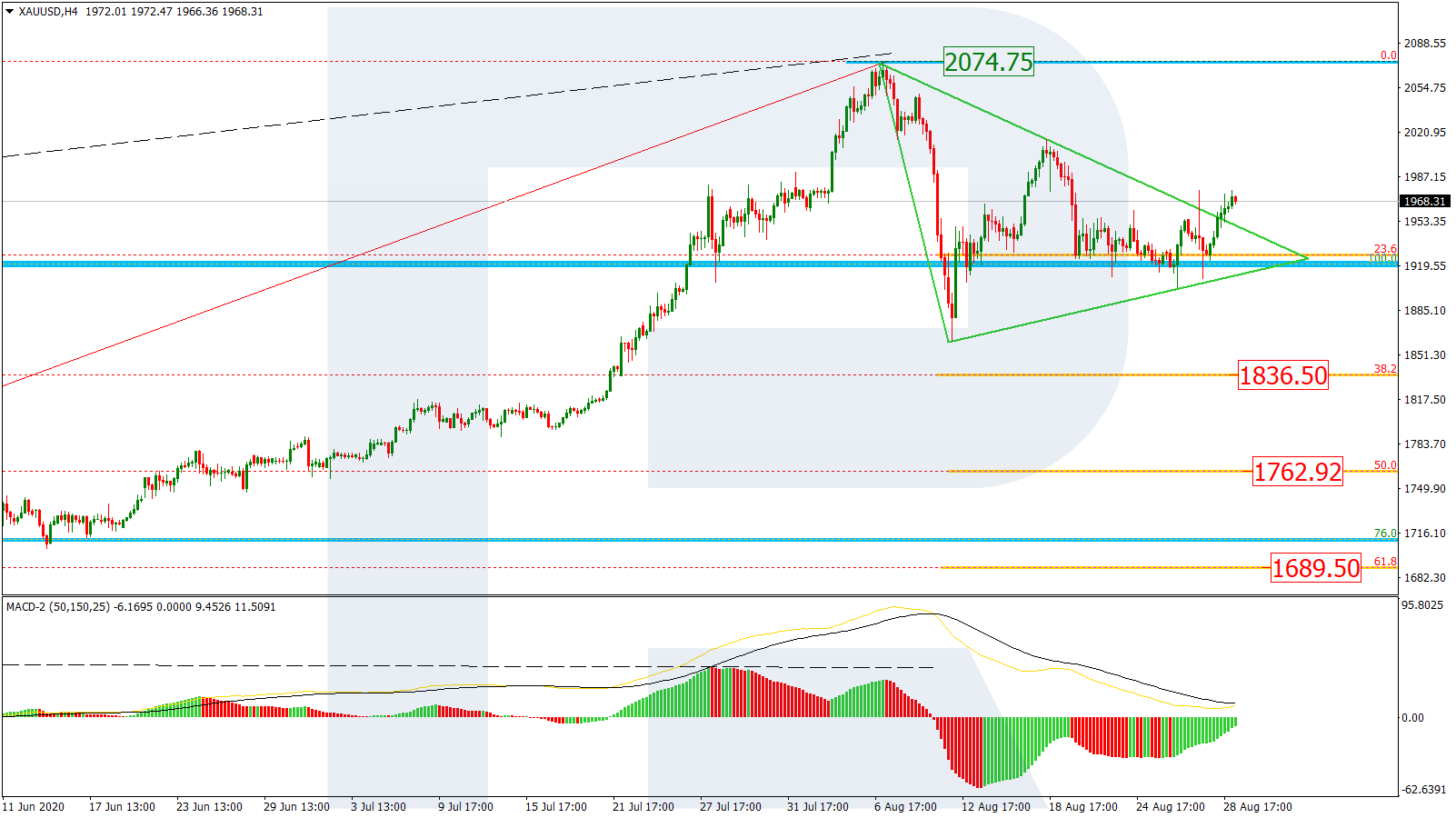

On H4, the picture of the correctional decline and the Triangle after a divergence is more detailed. The aims of the correction are 23.6% (1836.50 USD) 38.2% (1762.92 USD), and 50.0% Fibo (1689.50 USD). Breaking away the high of 2074.75 USD, the quotations will go on developing the uptrend.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

USDCHF

On D1, after a pullback to 61.8% Fibo, another wave of decline engulfed the low and reached the long-term level of 38.2% Fibo (0.9092 USD). Speaking locally and short-termly, the market is expecting a correction. However, after the pullback, the quotations may head for a long-term level of 50.0% Fibo (0.8706 USD).

On H4, the quotations are testing 38.2% Fibo (0.9092 USD) very thoroughly. Further decline qill aim at the post-correctional extension range of 138.2-161.8% Fibo (0.8898-0.8728 USD).

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024