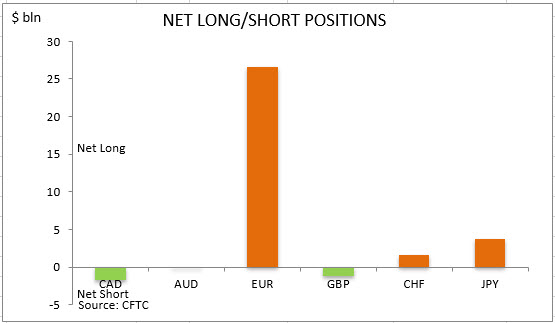

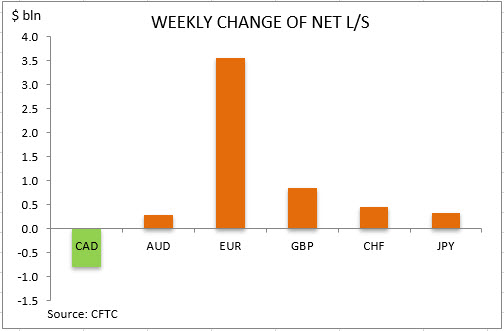

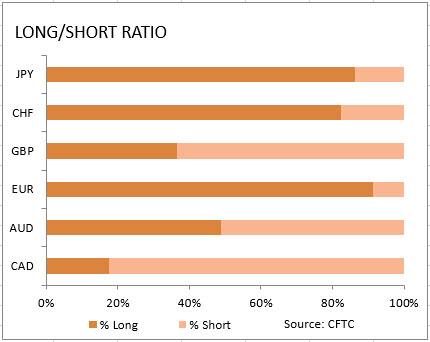

US dollar bearish bets increase slowed with total net shorts reaching $28.93 billion from $24.28 against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to August 4 and released on Friday August 7. The increase in net short dollar bets resulted from decreases in bearish bets on Australian dollar and significant increase in bullish bets on Japanese yen, Swiss franc and euro as euro-zone GDP decreased by 12.1% in the Q2 – markedly less than in the US. At the same time Markit reported the manufacturing activity across the euro zone expanded for the first time since early 2019. The bearish dollar bets rose again despite Institute for Supply Management report its manufacturing PMI rose to an above-expected reading of 54.2 in July. Readings above 50 indicate expansion in factory activity. Another negative factor was the US Labor Department report 1.434 million Americans filed for first-time unemployment benefits in the prior week, a rise of 14,000.

CFTC Sentiment vs Exchange Rate

| August 05 2020 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | negative | -1740 | -806 |

| AUD | bearish | negative | -75 | 284 |

| EUR | bullish | negative | 26640 | 3559 |

| GBP | bearish | negative | -1202 | 851 |

| CHF | bullish | negative | 1596 | 446 |

| JPY | bullish | negative | 3716 | 325 |

| Total | 28934 |

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Lean Hogs Apr 20, 2024

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024